Urbanization and Population Growth

Rapid urbanization and population growth in China are key drivers of the geospatial analytics market. As cities expand, the need for effective urban planning and resource management becomes paramount. Geospatial analytics provides essential tools for analyzing urban dynamics, optimizing land use, and managing public services. The urban population in China is projected to reach 1 billion by 2030, necessitating advanced analytics to address challenges such as traffic congestion and environmental sustainability. This demographic shift is likely to propel the geospatial analytics market, with an expected growth rate of around 14% over the next few years, as municipalities increasingly adopt data-driven approaches to urban management.

Advancements in Satellite Technology

Technological advancements in satellite imagery and remote sensing are significantly impacting the geospatial analytics market in China. The launch of new satellites with enhanced capabilities allows for more accurate and timely data collection. This is particularly relevant for sectors such as agriculture, environmental monitoring, and urban planning. The Chinese government has invested heavily in satellite technology, which is expected to bolster the geospatial analytics market by providing high-resolution data for analysis. As a result, the market is anticipated to expand by approximately 10% annually, driven by the increasing availability of precise geospatial data that supports informed decision-making.

Increased Focus on Disaster Management

The geospatial analytics market is experiencing growth in China due to an increased focus on disaster management and response strategies. Natural disasters, such as floods and earthquakes, pose significant risks to communities, prompting the government to invest in advanced analytics for risk assessment and emergency planning. Geospatial analytics enables authorities to visualize hazard zones, assess vulnerabilities, and develop effective response strategies. The Chinese government has recognized the importance of integrating geospatial data into disaster management frameworks, which is likely to drive market growth at a rate of approximately 11% annually. This focus on resilience and preparedness underscores the critical role of geospatial analytics in safeguarding communities.

Government Investment in Infrastructure

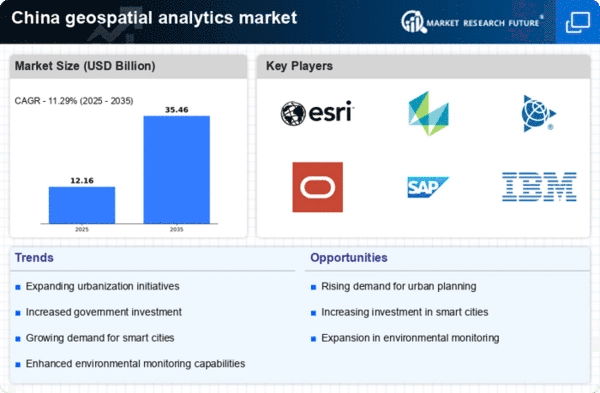

The geospatial analytics market in China is experiencing a surge. This surge is due to substantial government investment in infrastructure development. The Chinese government has allocated billions of dollars towards enhancing transportation networks, urban planning, and public services. This investment is likely to drive demand for geospatial analytics solutions, as they provide critical insights for optimizing infrastructure projects. For instance, the National Development and Reform Commission has emphasized the importance of integrating geospatial data into planning processes. As a result, the geospatial analytics market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years, reflecting the increasing reliance on data-driven decision-making in infrastructure projects.

Rising Demand for Location-Based Services

The geospatial analytics market is witnessing a significant increase in demand for location-based services across various sectors in China. Industries such as retail, logistics, and telecommunications are leveraging geospatial data to enhance customer experiences and optimize operations. For example, retailers are utilizing geospatial analytics to identify optimal store locations and tailor marketing strategies based on consumer behavior patterns. This trend is expected to contribute to a market growth rate of around 12% annually, as businesses recognize the value of location intelligence in gaining competitive advantages. Consequently, the geospatial analytics market is becoming increasingly integral to strategic planning and operational efficiency.