Rising Healthcare Expenditure

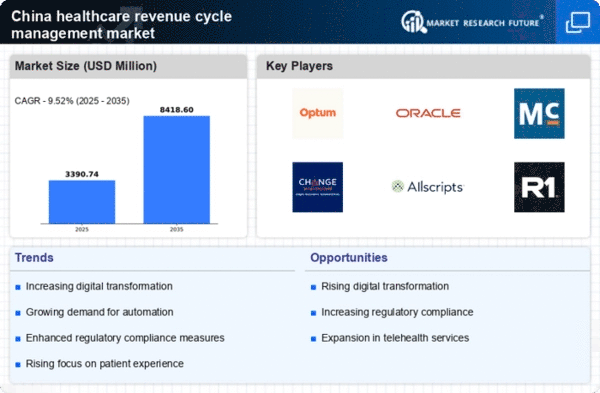

China's healthcare expenditure has been on a consistent upward trajectory, significantly impacting the healthcare revenue-cycle-management market. With the government prioritizing healthcare reforms and increasing funding, total healthcare spending is projected to exceed $1 trillion by 2025. This rise in expenditure is likely to lead to a greater volume of transactions and claims, necessitating robust revenue-cycle-management solutions to handle the increased workload. Healthcare providers are compelled to adopt advanced revenue-cycle-management systems to manage their finances effectively and ensure compliance with evolving regulations. As a result, the healthcare revenue-cycle-management market is expected to benefit from this trend, as providers seek to enhance their financial performance amidst rising costs and demand for quality care.

Shift Towards Value-Based Care

The transition from fee-for-service to value-based care models is reshaping the healthcare revenue-cycle-management market in China. This shift emphasizes patient outcomes and cost-effectiveness, compelling healthcare providers to adopt more sophisticated revenue-cycle-management strategies. As value-based care becomes more prevalent, providers must ensure accurate coding and billing practices to align with reimbursement models that reward quality over quantity. This transformation is likely to drive the demand for advanced analytics and reporting tools within the healthcare revenue-cycle-management market. By 2025, it is anticipated that the market will witness a growth rate of approximately 12%, as providers invest in technologies that facilitate this transition and improve their financial sustainability.

Technological Advancements in Data Management

Technological advancements in data management are significantly influencing the healthcare revenue-cycle-management market in China. The increasing volume of patient data necessitates the implementation of sophisticated data management systems to ensure accuracy and compliance. Healthcare providers are increasingly adopting cloud-based solutions and electronic health records (EHR) to streamline their revenue cycle processes. These technologies not only enhance data accessibility but also improve the efficiency of billing and claims processing. As a result, the healthcare revenue-cycle-management market is projected to grow at a rate of 14% annually, driven by the need for improved data management solutions that can handle the complexities of modern healthcare delivery.

Growing Focus on Compliance and Risk Management

The growing focus on compliance and risk management is a critical driver for the healthcare revenue-cycle-management market in China. As regulatory frameworks become more stringent, healthcare providers are compelled to adopt comprehensive compliance strategies to mitigate risks associated with billing and reimbursement processes. This trend is likely to lead to increased investments in revenue-cycle-management solutions that offer robust compliance features. By 2025, the market is expected to expand as providers seek to enhance their risk management capabilities and ensure adherence to evolving regulations. The emphasis on compliance not only protects healthcare organizations from potential penalties but also fosters trust among patients and stakeholders, thereby contributing to the overall growth of the healthcare revenue-cycle-management market.

Increasing Demand for Efficient Billing Solutions

The healthcare revenue-cycle-management market in China is experiencing a notable surge in demand for efficient billing solutions. As healthcare providers strive to optimize their financial operations, the need for streamlined billing processes becomes paramount. This demand is driven by the increasing complexity of healthcare services and the necessity for accurate billing to ensure timely reimbursements. In 2025, it is estimated that the market for healthcare revenue-cycle-management solutions in China could reach approximately $10 billion, reflecting a growth rate of around 15% annually. The integration of advanced technologies, such as artificial intelligence and machine learning, is likely to enhance billing accuracy and reduce errors, thereby improving overall revenue cycle efficiency. Consequently, this driver plays a crucial role in shaping the landscape of the healthcare revenue-cycle-management market.