Focus on Patient-Centric Care Models

The healthcare revenue-cycle-management market is increasingly influenced by the shift towards patient-centric care models in the GCC. Healthcare providers are recognizing the importance of engaging patients in their financial responsibilities, which necessitates the implementation of transparent billing practices. This trend is likely to enhance patient satisfaction and loyalty, as patients become more informed about their financial obligations. As a result, healthcare organizations are investing in revenue cycle management systems that facilitate clear communication regarding costs and payment options. This focus on patient engagement is expected to drive market growth, with projections indicating a potential increase in revenue cycle management adoption by 15% in the coming years.

Technological Advancements in Data Analytics

The healthcare revenue-cycle-management market is significantly impacted by technological advancements in data analytics within the GCC. The integration of sophisticated analytics tools allows healthcare organizations to gain insights into their financial performance, identify inefficiencies, and optimize revenue cycles. By leveraging data analytics, providers can enhance decision-making processes, leading to improved operational efficiency and reduced costs. In 2025, the market for analytics-driven revenue cycle management solutions is projected to grow by approximately 10%, as organizations increasingly recognize the value of data in driving financial success. This trend suggests a shift towards more informed and strategic management of revenue cycles.

Rising Demand for Efficient Billing Solutions

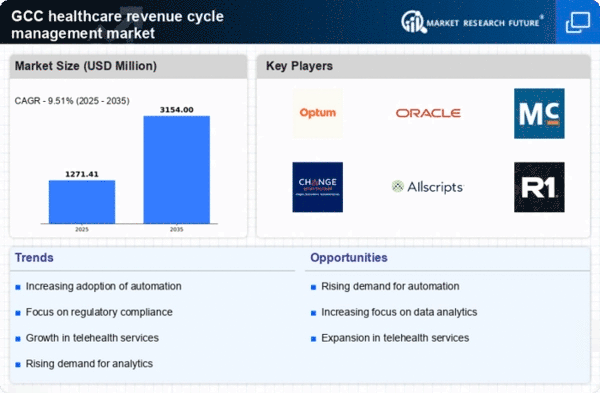

The healthcare revenue-cycle-management market is experiencing a notable surge in demand for efficient billing solutions across the GCC. As healthcare providers strive to optimize their financial performance, the need for streamlined billing processes becomes paramount. This demand is driven by the increasing complexity of healthcare billing, which often involves multiple payers and intricate reimbursement models. In 2025, it is estimated that the revenue cycle management solutions market in the GCC will reach approximately $1.5 billion, reflecting a growth rate of around 12% annually. This growth indicates a strong inclination towards adopting advanced billing solutions that enhance accuracy and reduce claim denials, ultimately improving cash flow for healthcare organizations.

Growing Emphasis on Cost Containment Strategies

The healthcare revenue-cycle-management market is increasingly shaped by the growing emphasis on cost containment strategies among healthcare providers in the GCC. As healthcare costs continue to rise, organizations are seeking ways to manage expenses while maintaining quality care. This focus on cost containment is driving the adoption of revenue cycle management solutions that streamline operations and reduce administrative burdens. It is estimated that by 2025, healthcare organizations in the GCC will allocate around 25% of their budgets to revenue cycle management initiatives aimed at cost reduction. This trend indicates a proactive approach to financial management, as providers seek to enhance profitability while delivering high-quality services.

Increased Regulatory Scrutiny and Compliance Needs

The healthcare revenue-cycle-management market is facing heightened regulatory scrutiny in the GCC, compelling healthcare organizations to prioritize compliance. As regulations evolve, providers must adapt their revenue cycle processes to meet new requirements, which can be complex and resource-intensive. This necessity for compliance is driving investments in revenue cycle management solutions that ensure adherence to regulatory standards. In 2025, it is anticipated that compliance-related expenditures in the healthcare sector will account for approximately 20% of total revenue cycle management budgets. This trend underscores the importance of integrating compliance features into revenue cycle management systems to mitigate risks and enhance operational integrity.