Rising Healthcare Expenditure

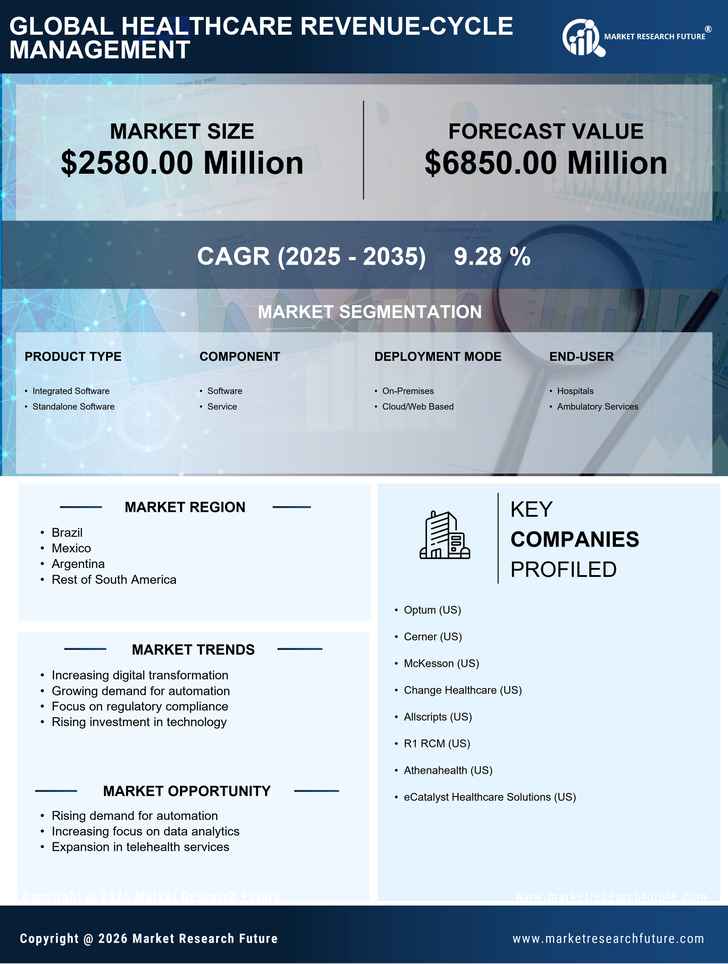

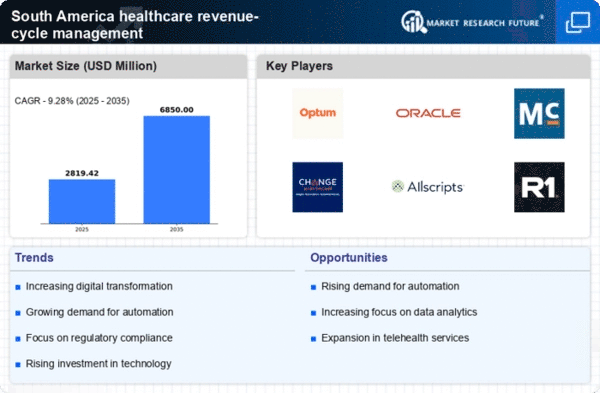

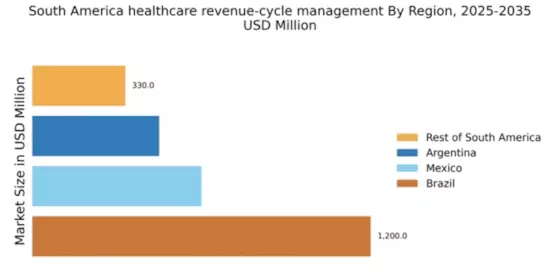

The healthcare revenue-cycle-management market in South America is poised for growth due to the rising healthcare expenditure across the region. Governments and private sectors are increasing their investments in healthcare infrastructure, which is expected to boost the demand for efficient revenue-cycle-management solutions. In 2025, healthcare spending in South America is anticipated to reach approximately $1 trillion, with a significant portion allocated to improving financial operations within healthcare facilities. This increase in expenditure is likely to drive healthcare organizations to adopt advanced revenue-cycle-management systems that can handle the complexities of billing and collections, ultimately enhancing their financial sustainability.

Emergence of Telehealth Services

The emergence of telehealth services is reshaping the healthcare revenue-cycle-management market in South America. As telehealth becomes more prevalent, healthcare providers must adapt their revenue-cycle-management strategies to accommodate remote consultations and digital health services. This shift presents both challenges and opportunities, as billing for telehealth services requires new coding and reimbursement processes. By 2025, it is projected that telehealth services could account for approximately 20% of all healthcare visits in the region. Consequently, healthcare organizations are likely to invest in revenue-cycle-management solutions that can effectively integrate telehealth billing, ensuring accurate reimbursement and improved financial performance.

Shift Towards Value-Based Care Models

The transition from fee-for-service to value-based care models is significantly influencing the healthcare revenue-cycle-management market in South America. This shift necessitates a comprehensive approach to revenue management, focusing on patient outcomes rather than service volume. Healthcare providers are increasingly required to demonstrate the value of their services, which in turn demands sophisticated revenue-cycle-management strategies. As of 2025, it is projected that around 30% of healthcare payments in South America will be linked to value-based care initiatives. This trend compels organizations to invest in analytics and reporting tools that can effectively track performance metrics, thereby enhancing their revenue-cycle-management capabilities.

Growing Focus on Data Security and Compliance

Data security and compliance are becoming critical drivers in the healthcare revenue-cycle-management market in South America. With the increasing digitization of healthcare records, organizations are under pressure to protect sensitive patient information while adhering to regulatory requirements. The implementation of robust revenue-cycle-management solutions that prioritize data security is essential for maintaining patient trust and avoiding costly penalties. As of 2025, it is estimated that compliance-related costs could account for up to 15% of total healthcare expenditures in the region. This growing focus on data security is likely to propel investments in advanced revenue-cycle-management technologies that offer enhanced security features.

Increasing Demand for Efficient Billing Solutions

The healthcare revenue-cycle-management market in South America is experiencing a notable surge in demand for efficient billing solutions. As healthcare providers strive to optimize their financial performance, the need for streamlined billing processes becomes paramount. This demand is driven by the rising complexity of healthcare services and the necessity for accurate billing to minimize revenue leakage. In 2025, it is estimated that the revenue-cycle-management market in South America could reach approximately $5 billion, reflecting a growth rate of around 12% annually. The increasing adoption of electronic health records (EHR) and automated billing systems is likely to enhance operational efficiency, thereby attracting more healthcare organizations to invest in advanced revenue-cycle-management solutions.