Surge in E-commerce Growth

The rapid expansion of e-commerce in China is a pivotal driver for the image recognition market. As online shopping continues to gain traction, retailers are increasingly adopting image recognition technologies to enhance customer experiences. This technology enables features such as visual search, allowing consumers to find products using images rather than text. In 2025, the e-commerce sector in China is projected to reach approximately $2 trillion, indicating a substantial market opportunity for image recognition solutions. The integration of these technologies not only streamlines the shopping process but also aids in inventory management and personalized marketing strategies, thereby propelling the image recognition market forward.

Technological Advancements in AI

Ongoing advancements in artificial intelligence are significantly influencing the image recognition market. Innovations in machine learning algorithms and neural networks are enhancing the accuracy and efficiency of image recognition systems. In China, companies are investing heavily in research to develop more sophisticated technologies that can process images with greater precision. The market is witnessing a shift towards deep learning techniques, which are expected to dominate the landscape in the coming years. This technological evolution not only improves existing applications but also opens new avenues for the image recognition market, potentially leading to a broader range of use cases across various industries.

Government Initiatives and Support

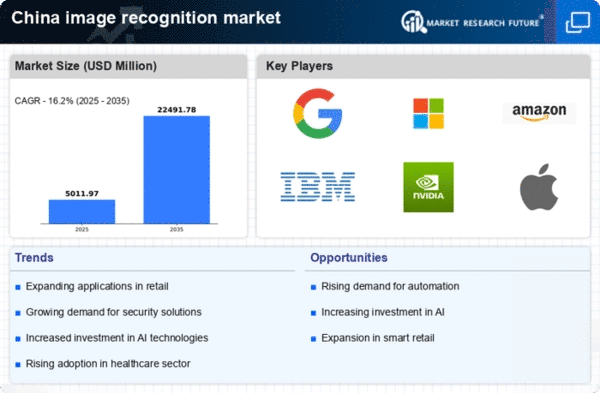

The Chinese government has been actively promoting the development of artificial intelligence, including image recognition technologies. Various initiatives and funding programs have been established to encourage research and development in this field. The government's commitment to advancing AI is evident in its strategic plans, which aim to position China as a leader in technology by 2030. This supportive environment fosters innovation and investment in the image recognition market, potentially leading to a compound annual growth rate (CAGR) of over 20% in the coming years. Such initiatives not only enhance the capabilities of image recognition systems but also stimulate collaboration between public and private sectors.

Integration with Mobile Applications

The proliferation of smartphones and mobile applications in China is a crucial driver for the image recognition market. As mobile technology continues to evolve, applications utilizing image recognition capabilities are becoming increasingly popular among consumers. Features such as augmented reality shopping experiences and visual search functionalities are enhancing user engagement and satisfaction. In 2025, it is estimated that over 1 billion smartphones will be in use in China, creating a vast market for image recognition applications. This integration not only facilitates seamless interactions but also encourages businesses to adopt image recognition technologies to remain competitive in a rapidly changing digital landscape.

Rising Demand for Security Solutions

The increasing need for enhanced security measures in urban areas is driving the image recognition market. With urbanization and population density on the rise, there is a growing emphasis on public safety and surveillance. Image recognition technologies are being deployed in various applications, including facial recognition for law enforcement and monitoring public spaces. The market for security solutions is expected to grow significantly, with estimates suggesting a valuation of over $30 billion by 2026. This trend indicates a robust demand for image recognition systems that can provide real-time analysis and improve overall security infrastructure.