Increased Defense Spending

In recent years, the Chinese government has significantly increased its defense budget, which has a direct impact on the China military laser rangefinder market. The focus on modernizing the military and enhancing its capabilities has led to a surge in demand for advanced military equipment, including laser rangefinders. According to government reports, defense spending is expected to reach approximately USD 300 billion by 2026, with a substantial portion allocated to research and development of cutting-edge technologies. This increase in funding is likely to facilitate the procurement of high-performance laser rangefinders, thereby driving market growth and fostering competition among domestic manufacturers.

Technological Advancements

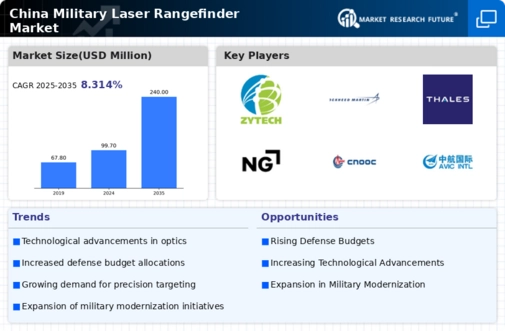

The China military laser rangefinder market is experiencing rapid technological advancements, which are enhancing the capabilities and performance of these devices. Innovations in laser technology, such as the development of solid-state lasers and improved optics, are leading to more accurate and reliable rangefinding solutions. The integration of advanced materials and miniaturization techniques is also contributing to the production of lightweight and portable rangefinders. As a result, the Chinese military is increasingly adopting these advanced systems for various applications, including artillery targeting and reconnaissance missions. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 5% in the coming years, driven by these technological improvements.

Focus on Domestic Production

The China military laser rangefinder market is witnessing a strong emphasis on domestic production, driven by the government's policy to reduce reliance on foreign technology. The Chinese government has implemented initiatives to promote local manufacturers, encouraging them to develop and produce advanced military equipment, including laser rangefinders. This focus on self-sufficiency is evident in the establishment of research and development centers and partnerships between military and civilian sectors. As a result, domestic companies are increasingly capable of producing high-quality laser rangefinders that meet the specific needs of the Chinese military. This trend is expected to bolster the market, as local manufacturers gain a competitive edge and contribute to the overall growth of the industry.

Growing Demand for Precision Targeting

The growing demand for precision targeting in military operations is a key driver for the China military laser rangefinder market. As the Chinese military seeks to enhance its operational effectiveness, the need for accurate and reliable targeting solutions has become paramount. Laser rangefinders play a crucial role in providing real-time distance measurements, which are essential for effective artillery and missile strikes. The increasing complexity of modern warfare necessitates the integration of advanced targeting systems, further propelling the demand for laser rangefinders. Market analysts project that this trend will continue, with the market for precision targeting solutions, including laser rangefinders, expected to expand significantly in the next few years.

Strategic Military Modernization Initiatives

The China military laser rangefinder market is significantly influenced by the strategic military modernization initiatives undertaken by the Chinese government. These initiatives aim to enhance the overall capabilities of the armed forces, focusing on advanced technologies and equipment. The modernization efforts include the integration of laser rangefinders into various military platforms, such as armored vehicles and aircraft, to improve operational efficiency. The Chinese military's commitment to adopting state-of-the-art technologies is likely to drive the demand for laser rangefinders, as they are essential for modern combat scenarios. As these initiatives progress, the market is expected to witness substantial growth, reflecting the increasing importance of advanced rangefinding solutions in military operations.