Increased Defense Spending

In recent years, the French government has significantly increased its defense budget, which has a direct impact on the France military laser rangefinder market. The commitment to enhancing national security and military capabilities has led to substantial investments in advanced technologies, including laser rangefinders. In 2025, the defense budget reached approximately 52 billion euros, with a notable portion allocated to modernization programs. This financial support enables the procurement of cutting-edge equipment, ensuring that the French military remains competitive on the global stage. As a result, manufacturers in the laser rangefinder sector are likely to benefit from increased orders and contracts, further stimulating market growth. The focus on enhancing operational efficiency and effectiveness in military operations underscores the importance of these devices in contemporary warfare.

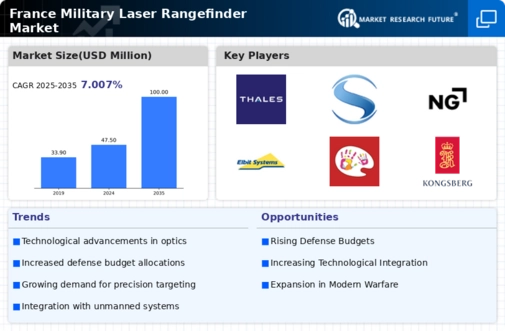

Technological Advancements

The France military laser rangefinder market is experiencing a notable transformation due to rapid technological advancements. Innovations in laser technology, such as improved wavelength and pulse duration, enhance the accuracy and range of these devices. The integration of advanced optics and digital signal processing allows for real-time data analysis, which is crucial for military operations. Furthermore, the development of compact and lightweight designs facilitates ease of use in various terrains. According to recent data, the market is projected to grow at a CAGR of 5.2% over the next five years, driven by these technological improvements. As the French military seeks to modernize its equipment, the demand for state-of-the-art laser rangefinders is likely to increase, positioning the industry for substantial growth.

Focus on Precision and Accuracy

The emphasis on precision and accuracy in military operations is a driving force behind the growth of the France military laser rangefinder market. As modern warfare evolves, the need for precise targeting and measurement becomes paramount. Laser rangefinders provide critical data that enhances situational awareness and decision-making capabilities for military personnel. The French military's strategic initiatives prioritize the integration of high-precision equipment to improve operational outcomes. Recent reports indicate that the demand for laser rangefinders has surged, with a projected market value of 150 million euros by 2027. This focus on precision not only enhances combat effectiveness but also minimizes collateral damage, aligning with contemporary military ethics. Consequently, manufacturers are investing in research and development to produce more accurate and reliable rangefinding solutions.

Integration with Advanced Systems

The integration of laser rangefinders with advanced military systems is a pivotal driver for the France military laser rangefinder market. As the French military adopts more sophisticated platforms, such as drones and armored vehicles, the need for seamless integration of rangefinding technology becomes critical. This integration enhances the overall effectiveness of military operations by providing accurate distance measurements that inform targeting and navigation systems. Recent initiatives have seen the French military investing in systems that combine laser rangefinders with other technologies, such as GPS and advanced optics. This trend is expected to propel the market forward, with projections indicating a growth rate of 6% annually over the next few years. The synergy between laser rangefinders and advanced military systems underscores the importance of these devices in modern warfare.

Growing Demand for Portable Solutions

The trend towards portable and lightweight military equipment is significantly influencing the France military laser rangefinder market. As military operations increasingly occur in diverse and challenging environments, the need for easily transportable devices has become essential. Modern laser rangefinders are designed to be compact, allowing soldiers to carry them without compromising mobility. This shift is reflected in the market, where portable rangefinders are gaining popularity among military units. Data suggests that the segment of portable laser rangefinders is expected to account for over 40% of the total market share by 2026. The French military's focus on enhancing soldier capabilities through lightweight technology further drives this demand, as it aligns with the broader trend of increasing operational efficiency in the field.