Technological Advancements

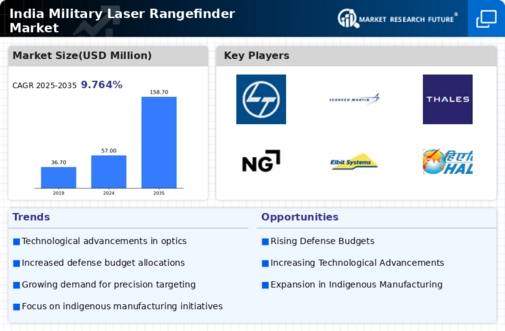

Rapid technological advancements are significantly influencing The India Military Laser Rangefinder Market. The integration of cutting-edge technologies such as artificial intelligence, machine learning, and advanced optics is enhancing the accuracy and efficiency of laser rangefinders. These innovations allow for improved target acquisition and engagement, which are critical in modern warfare scenarios. Furthermore, the development of compact and lightweight designs is making these devices more user-friendly for soldiers in the field. As the Indian military seeks to modernize its equipment, the demand for technologically advanced laser rangefinders is expected to rise. In 2025, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 8%, reflecting the increasing emphasis on high-tech solutions in defense operations.

Growing Geopolitical Tensions

The india military laser rangefinder market is being shaped by growing geopolitical tensions in the region. As India faces challenges from neighboring countries, there is an urgent need to enhance military preparedness and capabilities. The increasing focus on border security and defense readiness has led to a surge in demand for advanced military equipment, including laser rangefinders. These devices play a crucial role in reconnaissance and targeting, making them essential for modern military operations. In response to these challenges, the Indian government is likely to prioritize investments in advanced technologies, thereby stimulating growth in the laser rangefinder market. The heightened security concerns are expected to drive both domestic and international collaborations, further expanding the market opportunities for manufacturers in The India Military Laser Rangefinder Market.

Increased Defense Budget Allocation

The india military laser rangefinder market is poised for growth due to increased defense budget allocations by the Indian government. In recent years, the defense budget has seen a consistent rise, with a focus on enhancing the capabilities of the armed forces. For instance, the 2025 defense budget allocated a substantial portion to modernization programs, which include the procurement of advanced laser rangefinders. This financial commitment indicates the government's recognition of the importance of precision targeting and situational awareness in contemporary military operations. As a result, manufacturers are likely to benefit from increased orders and contracts, leading to a more competitive market landscape. The emphasis on upgrading military technology is expected to drive innovation and development within The India Military Laser Rangefinder Market.

Indigenous Manufacturing Initiatives

The India military laser rangefinder market is experiencing a notable shift towards indigenous manufacturing, driven by government initiatives aimed at self-reliance in defense production. The Make in India program encourages domestic companies to develop and manufacture advanced military technologies, including laser rangefinders. This initiative not only reduces dependency on foreign suppliers but also fosters innovation within the country. As a result, several Indian firms are investing in research and development to create competitive products that meet the specific needs of the Indian Armed Forces. The government's focus on indigenization is expected to enhance the capabilities of the military while simultaneously boosting the local economy. In 2025, the Indian defense sector saw a significant increase in contracts awarded to local manufacturers, indicating a positive trend for the future of The India Military Laser Rangefinder Market.

Focus on Modernization of Armed Forces

The india military laser rangefinder market is significantly influenced by the ongoing focus on the modernization of the Indian Armed Forces. The government has recognized the necessity of upgrading military capabilities to address contemporary threats and challenges. This modernization drive encompasses the acquisition of advanced technologies, including laser rangefinders, which are vital for enhancing operational effectiveness. The 2025 defense procurement policy emphasizes the need for state-of-the-art equipment to ensure that the armed forces remain competitive. As a result, there is a growing demand for high-performance laser rangefinders that can provide accurate distance measurements and improve targeting precision. This trend is likely to create a favorable environment for manufacturers and suppliers in The India Military Laser Rangefinder Market, as they align their offerings with the evolving needs of the military.