Evolving Consumer Preferences

Consumer preferences in China are shifting towards more innovative and less invasive methods of nicotine consumption. The nicotine oral-dissolvable-thin-films market is benefiting from this evolution, as these products offer a discreet and user-friendly alternative to traditional smoking. Surveys indicate that younger demographics, particularly those aged 18-30, are more inclined to try new nicotine delivery systems. This demographic shift is crucial, as it suggests a potential for long-term market growth. Additionally, the convenience of these films, which can be consumed without the need for additional equipment, aligns well with the fast-paced lifestyle of urban consumers. As preferences continue to evolve, the nicotine oral-dissolvable-thin-films market is likely to capture a larger share of the nicotine consumption landscape in China.

Rising Awareness of Harm Reduction Strategies

There is a growing awareness of harm reduction strategies among the Chinese population, which is positively influencing the nicotine oral-dissolvable-thin-films market. As public health campaigns emphasize the importance of reducing the risks associated with smoking, consumers are becoming more informed about alternative nicotine delivery systems. This shift in awareness is likely to drive demand for products that are perceived as safer and less harmful than traditional cigarettes. The nicotine oral-dissolvable-thin-films market will benefit from this trend, as these products are often marketed as a less harmful option. Furthermore, the increasing availability of educational resources regarding harm reduction may further bolster consumer interest and acceptance, potentially leading to a more robust market presence.

Increasing Demand for Smoking Cessation Products

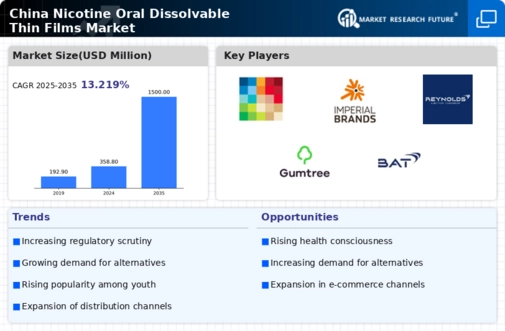

The nicotine oral-dissolvable-thin-films market in China is experiencing a notable surge in demand for smoking cessation products. This trend is largely driven by the increasing awareness of the health risks associated with traditional smoking. According to recent studies, approximately 28% of Chinese adults smoke, and there is a growing push from health authorities to reduce this figure. The convenience and discreet nature of oral-dissolvable films attract smokers looking for alternatives. Furthermore, the market is projected to grow at a CAGR of around 15% over the next five years, indicating a robust potential for expansion in the nicotine oral-dissolvable-thin-films market. This increasing demand is likely to be supported by various public health campaigns aimed at promoting smoking cessation, thereby enhancing the market's growth prospects.

Technological Advancements in Product Development

Technological advancements are playing a pivotal role in the evolution of the nicotine oral-dissolvable-thin-films market. Innovations in formulation and manufacturing processes are enabling the development of more effective and palatable products. For instance, improvements in flavoring techniques and film dissolution rates are enhancing user experience, which is crucial for consumer acceptance. Additionally, the integration of smart technology in product design, such as dosage control features, is likely to attract tech-savvy consumers. As these advancements continue to emerge, they may significantly impact the competitive landscape, allowing companies to differentiate their offerings in the nicotine oral-dissolvable-thin-films market. This focus on innovation could lead to increased market penetration and consumer loyalty.

Regulatory Changes Favoring Alternative Nicotine Products

Recent regulatory changes in China appear to favor the development and distribution of alternative nicotine products, including oral-dissolvable films. The government has been increasingly supportive of initiatives aimed at reducing smoking rates, which may lead to a more favorable environment for the nicotine oral-dissolvable-thin-films market. For instance, new regulations may streamline the approval process for these products, making it easier for manufacturers to bring them to market. This regulatory support could potentially enhance consumer access to safer alternatives, thereby driving market growth. Furthermore, as the government continues to implement stricter regulations on traditional tobacco products, the nicotine oral-dissolvable-thin-films market may see a significant uptick in demand as consumers seek compliant alternatives.