Government Support and Investment

The China virtual reality software market benefits from substantial government support and investment. The Chinese government has recognized the potential of virtual reality technology in various sectors, including education, healthcare, and entertainment. In recent years, initiatives such as the 'Made in China 2025' plan have aimed to promote advanced technologies, including virtual reality. This has led to increased funding for research and development, as well as the establishment of innovation hubs. As a result, the market is witnessing a surge in the development of VR applications tailored to local needs, which could enhance user engagement and drive adoption across different demographics.

Advancements in Hardware Technology

Advancements in hardware technology are playing a crucial role in the growth of the China virtual reality software market. The development of more powerful and affordable VR headsets, along with improved graphics and processing capabilities, is making virtual reality more accessible to consumers and businesses alike. Companies are investing in research to enhance the user experience, leading to the introduction of lightweight, wireless headsets that offer greater mobility and comfort. As hardware continues to evolve, it is anticipated that the user base for VR applications will expand, driving demand for innovative software solutions that leverage these advancements.

Rise of E-commerce and Virtual Shopping

The rise of e-commerce and virtual shopping experiences is emerging as a key driver in the China virtual reality software market. As online shopping continues to gain traction, retailers are exploring VR technologies to create immersive shopping experiences that allow consumers to interact with products in a virtual environment. This trend is particularly relevant in the context of China's rapidly growing e-commerce sector, which is expected to surpass 2 trillion USD by 2026. By integrating VR into their platforms, retailers can enhance customer engagement and satisfaction, potentially leading to increased sales and brand loyalty. This shift towards virtual shopping experiences is likely to propel the demand for VR software solutions.

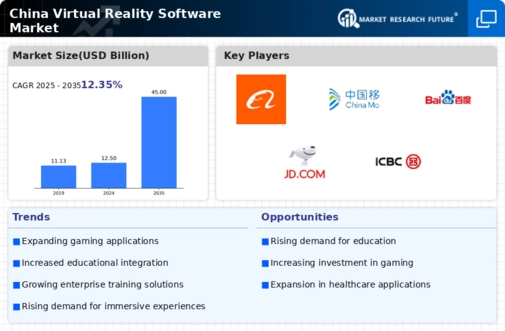

Growing Demand for Immersive Entertainment

The demand for immersive entertainment experiences is a significant driver in the China virtual reality software market. With the rapid growth of the gaming sector, consumers are increasingly seeking more engaging and interactive experiences. According to recent data, the gaming industry in China is projected to reach over 40 billion USD by 2026, with a substantial portion attributed to virtual reality games. This trend is encouraging software developers to create innovative VR content that captivates users. Furthermore, the rise of VR arcades and entertainment centers across major cities is likely to bolster the market, providing consumers with access to cutting-edge VR experiences.

Integration of VR in Training and Simulation

The integration of virtual reality in training and simulation applications is transforming the China virtual reality software market. Industries such as manufacturing, aviation, and military are increasingly adopting VR for training purposes, as it allows for safe, cost-effective, and realistic simulations. For instance, companies are utilizing VR to train employees in complex procedures without the risks associated with real-world training. This trend is expected to grow, with the market for VR training solutions projected to expand significantly in the coming years. The ability to provide immersive training experiences is likely to enhance skill acquisition and retention, making VR an attractive option for organizations.