Urbanization Trends

The rapid urbanization trends in China are anticipated to significantly impact the welded pipes market. As urban populations grow, the demand for housing, commercial buildings, and public utilities increases, necessitating the use of welded pipes for plumbing and construction applications. The welded pipes market is likely to see a surge in demand, with projections indicating a growth rate of around 5% annually through 2025. This urbanization trend not only drives the need for infrastructure but also influences the types of materials used, with welded pipes being favored for their durability and cost-effectiveness. Consequently, the urbanization phenomenon is a key driver for the welded pipes market.

Energy Sector Expansion

China's energy sector is undergoing rapid expansion, which is expected to bolster the welded pipes market. The country is investing heavily in renewable energy sources, such as wind and solar power, alongside traditional energy sectors like oil and gas. The welded pipes market stands to benefit from this trend, as these pipes are crucial for transporting fluids and gases in energy applications. Reports suggest that the demand for welded pipes in the energy sector could account for approximately 30% of the total market share by 2025. This expansion reflects the increasing reliance on welded pipes for energy infrastructure, thereby driving growth in the welded pipes market.

Industrial Growth and Manufacturing

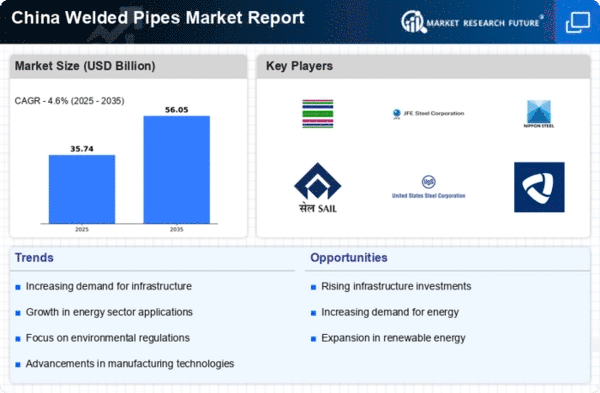

The industrial growth and manufacturing sector in China are poised to propel the welded pipes market forward. As the country continues to strengthen its manufacturing capabilities, the demand for welded pipes in various industries, including automotive, construction, and machinery, is expected to rise. The welded pipes market may experience a compound annual growth rate (CAGR) of approximately 6% from 2025 to 2030, driven by the increasing need for robust piping solutions in manufacturing processes. This growth is indicative of the essential role that welded pipes play in supporting industrial applications, thereby enhancing the overall market landscape.

Infrastructure Development Initiatives

The ongoing infrastructure development initiatives in China are likely to drive the welded pipes market. The government has allocated substantial funding for various projects, including transportation, energy, and water supply systems. For instance, the 14th Five-Year Plan emphasizes the construction of new railways and highways, which necessitates the use of high-quality welded pipes. The demand for welded pipes in these sectors is projected to increase significantly, potentially reaching a market value of $10 billion by 2026. This growth is indicative of the essential role that welded pipes play in supporting the country's infrastructure ambitions, thereby enhancing the welded pipes market.

Environmental Regulations and Standards

The tightening of environmental regulations and standards in China is likely to influence the welded pipes market positively. As the government implements stricter guidelines to reduce pollution and promote sustainable practices, industries are compelled to adopt high-quality welded pipes that meet these standards. The welded pipes market may see a shift towards more eco-friendly materials and manufacturing processes, potentially increasing the market size by 15% by 2027. This regulatory environment not only encourages innovation in the production of welded pipes but also aligns with the broader goals of environmental sustainability, thereby driving growth in the welded pipes market.