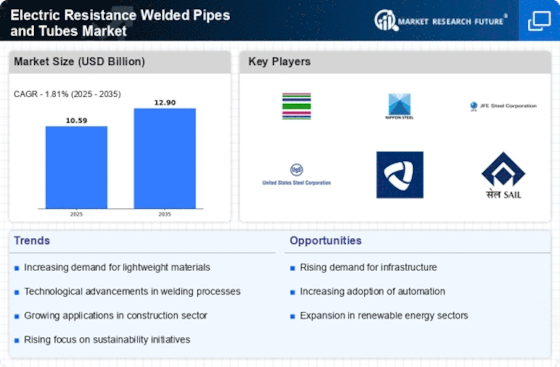

Growing Energy Sector Investments

The Electric Resistance Welded Pipes and Tubes Market is benefiting from increased investments in the energy sector, particularly in oil and gas exploration and production. As energy demands rise, there is a corresponding need for efficient transportation of resources, which electric resistance welded pipes are well-suited for. In 2025, the energy sector is anticipated to invest heavily in infrastructure development, including pipelines and distribution systems. This trend is likely to create substantial opportunities for manufacturers of electric resistance welded pipes and tubes, as these products are essential for ensuring the safe and efficient transport of energy resources. The ongoing expansion of renewable energy projects also presents new avenues for growth within the Electric Resistance Welded Pipes and Tubes Market.

Increased Focus on Sustainability

The Electric Resistance Welded Pipes and Tubes Market is witnessing a shift towards sustainability, driven by both consumer preferences and regulatory pressures. As industries strive to reduce their carbon footprint, there is a growing demand for eco-friendly materials and processes. Electric resistance welded pipes, which can be produced with lower energy consumption compared to traditional methods, are becoming increasingly attractive. In 2025, sustainability initiatives are expected to influence procurement decisions across various sectors, including construction and energy. This trend may lead to a higher adoption rate of electric resistance welded pipes, as they align with the goals of reducing environmental impact. Consequently, the Electric Resistance Welded Pipes and Tubes Market is likely to experience growth fueled by this heightened focus on sustainability.

Rising Demand in Construction Sector

The Electric Resistance Welded Pipes and Tubes Market is experiencing a surge in demand driven by the construction sector. As urbanization accelerates, the need for robust infrastructure, including water supply systems, sewage systems, and structural applications, is increasing. In 2025, the construction industry is projected to grow at a rate of approximately 5.5% annually, which directly influences the demand for electric resistance welded pipes and tubes. These products are favored for their strength and reliability, making them essential in various construction applications. Furthermore, the trend towards prefabrication in construction is likely to enhance the demand for these welded pipes, as they are easier to transport and install. This growing construction activity is expected to significantly bolster the Electric Resistance Welded Pipes and Tubes Market.

Advancements in Manufacturing Technologies

Technological innovations in manufacturing processes are playing a pivotal role in shaping the Electric Resistance Welded Pipes and Tubes Market. The introduction of advanced welding techniques, such as high-frequency induction welding, has improved the efficiency and quality of welded pipes. These advancements not only enhance the mechanical properties of the pipes but also reduce production costs, making them more competitive in the market. In 2025, the market is likely to witness a shift towards automated manufacturing processes, which can increase production rates and ensure consistent quality. This technological evolution is expected to attract new players into the Electric Resistance Welded Pipes and Tubes Market, further stimulating competition and innovation.

Regulatory Support for Infrastructure Development

Government policies and regulations aimed at enhancing infrastructure development are significantly impacting the Electric Resistance Welded Pipes and Tubes Market. Many governments are prioritizing investments in public infrastructure, which includes transportation, water supply, and energy systems. In 2025, various initiatives are expected to be launched to support the construction of new pipelines and tubes, thereby increasing the demand for electric resistance welded products. Regulatory frameworks that promote the use of high-quality materials in infrastructure projects further bolster the market, as electric resistance welded pipes are recognized for their durability and performance. This supportive regulatory environment is likely to drive growth in the Electric Resistance Welded Pipes and Tubes Market.