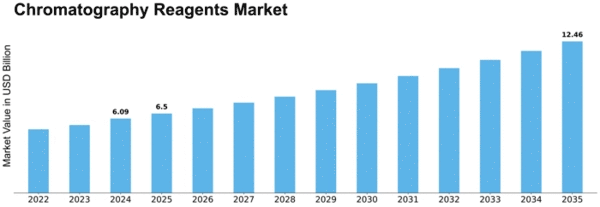

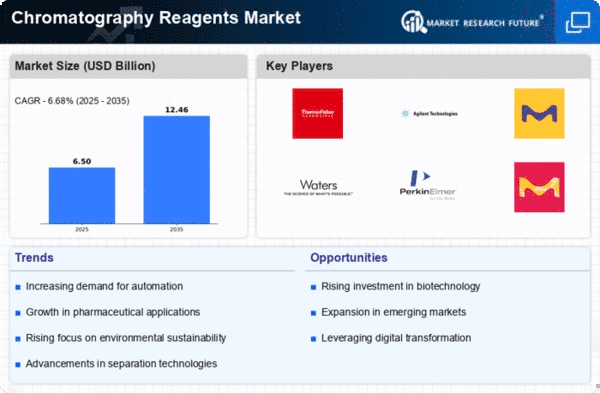

Chromatography Reagents Size

Chromatography Reagents Market Growth Projections and Opportunities

The Chromatography Reagents Market is significantly influenced by the rising demand for pharmaceuticals. As pharmaceutical research and development activities expand globally, chromatography reagents play a crucial role in various stages of drug discovery, leading to a substantial market growth. Techniques of chromatography have important use of detection of contaminants in the safety of different food product, which has expansion of chromatography reagents market. The market is also transformed by the growing concern in environmental monitoring. Chromatography methods along with instrumental analysis for a variety of samples including air, water, soil have found enormous scope in the environmental sector to detect pollutants. Harsher environmental regulations increase the demand for chromatography reagents in this industry. HPLC and GC, a current chromatography technology, are currently in the development stages and give rise to the need for specially designed reagents. The market is profiting from innovations that increase efficiency, precision, as well as speed in the analytical process which attracts more users and investors. The current developments within the biopharmaceutical industry affects directly the chromatography reagents market. The need for chromatography reagents for purification and analysis grows proportionately to the rate of biologics and biosimilars being produced, leading to the further growing market. Governments, universities, other institutions and private companies funding scientific research increases the demand for the chromatography reagents, since they are imperative components in all analytical work. The market dynamics are underpinned by the internationalization of the life sciences industry. As border collaborative lab initiatives and partnerships increase the demand for chromatography reagents as they are integral parts in laboratories across the globe which is the driver of growth for the market. More strict regulations in pharmaceuticals, biotechnology, food and beverages necessitate the use of high-quality chromatography reagents. According to market research, the need for precise and accurate reagents due to compliance with regulatory standards dictates the demand of this particular market. This region of Asia-Pacific has started holding importance as new market for chromatography reagents. Pharmaceutical and biotechnology industries in countries such as China and India are growing on larger scale with increasing investments in the brief and this has direct impact on chromatography reagents demands in this region. The rising focus on personalized medicine and targeted therapies fuels the demand for chromatography reagents. These reagents are essential for the analysis and purification of biomolecules, supporting the development of personalized treatments and contributing to market expansion.

Leave a Comment