Increasing Incidence of Cancer

The rising incidence of cancer worldwide is a primary driver for the Circulating Tumor DNA (ctDNA) Market. As cancer cases continue to escalate, the demand for effective diagnostic and monitoring tools becomes more pronounced. According to recent statistics, cancer is projected to affect millions annually, necessitating innovative solutions for early detection and treatment monitoring. ctDNA testing offers a non-invasive method to identify tumor presence and genetic mutations, which is crucial for personalized medicine. This trend is likely to propel the ctDNA market, as healthcare providers seek advanced technologies to improve patient outcomes and reduce treatment costs. Furthermore, the increasing awareness of cancer screening and the importance of early diagnosis are expected to further stimulate market growth.

Increased Awareness and Education

The growing awareness and education surrounding cancer and its diagnostics are crucial drivers for the Circulating Tumor DNA (ctDNA) Market. As patients become more informed about their health and the importance of early detection, the demand for advanced diagnostic tools like ctDNA testing is expected to rise. Educational campaigns by healthcare organizations and advocacy groups are playing a vital role in disseminating information about the benefits of ctDNA testing, including its non-invasive nature and ability to provide actionable insights. This heightened awareness is likely to lead to increased adoption of ctDNA tests in clinical settings, thereby expanding the market. Furthermore, as healthcare providers emphasize the importance of personalized treatment plans, the role of ctDNA in guiding these decisions is becoming increasingly recognized.

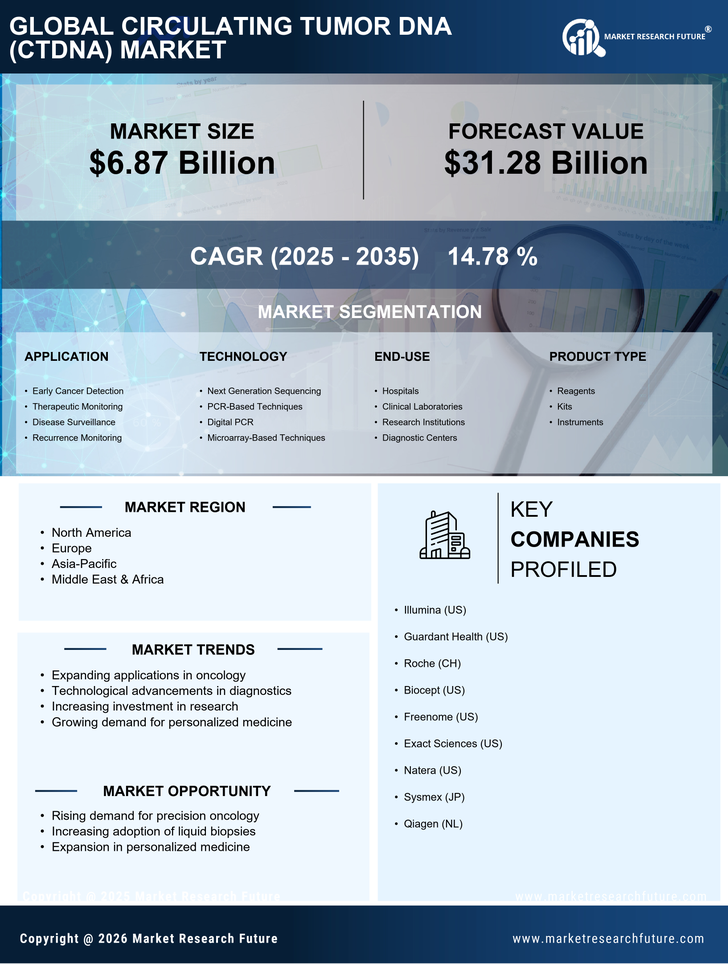

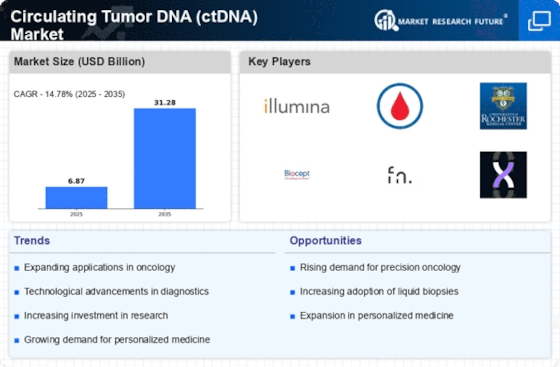

Advancements in Genomic Technologies

Technological advancements in genomic sequencing and analysis are significantly influencing the Circulating Tumor DNA (ctDNA) Market. Innovations such as next-generation sequencing (NGS) have enhanced the sensitivity and specificity of ctDNA tests, allowing for the detection of minimal residual disease and early relapse. The market for genomic technologies is anticipated to grow substantially, with estimates suggesting a compound annual growth rate of over 10% in the coming years. These advancements not only improve diagnostic accuracy but also facilitate the development of targeted therapies, thereby expanding the application of ctDNA in oncology. As a result, the integration of cutting-edge genomic technologies into clinical practice is likely to drive the demand for ctDNA testing, positioning it as a cornerstone in cancer management.

Rising Investment in Cancer Research

The surge in investment for cancer research is a notable driver for the Circulating Tumor DNA (ctDNA) Market. Governments, private organizations, and philanthropic entities are allocating substantial funds to advance cancer research initiatives. This influx of capital is directed towards developing innovative diagnostic tools, including ctDNA assays, which are essential for understanding tumor biology and improving patient care. Recent reports indicate that funding for cancer research has reached unprecedented levels, with billions of dollars being invested annually. This financial support not only accelerates the development of ctDNA technologies but also fosters collaborations between academia and industry, enhancing the overall landscape of cancer diagnostics. As research progresses, the ctDNA market is likely to benefit from new discoveries and applications.

Growing Focus on Personalized Medicine

The shift towards personalized medicine is a significant driver for the Circulating Tumor DNA (ctDNA) Market. Personalized medicine aims to tailor treatment strategies based on individual patient profiles, including genetic makeup and tumor characteristics. ctDNA testing plays a pivotal role in this approach by providing real-time insights into tumor dynamics and treatment response. The market for personalized medicine is expected to witness robust growth, with projections indicating a valuation exceeding several billion dollars in the next few years. This trend is fueled by the increasing recognition of the limitations of traditional one-size-fits-all therapies. Consequently, the demand for ctDNA testing as a tool for guiding personalized treatment decisions is likely to expand, further solidifying its importance in oncology.