Market Analysis

In-depth Analysis of Clinical Laboratory Test Market Industry Landscape

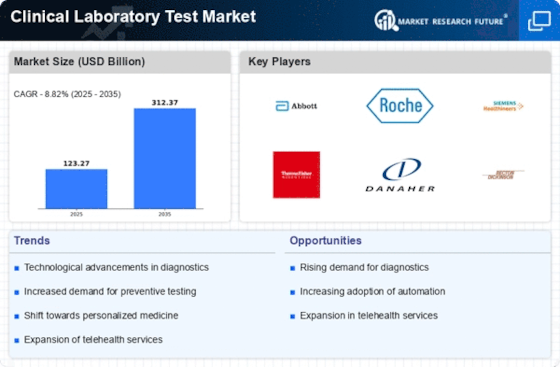

The market dynamics of the clinical laboratory test market are influenced by various factors that impact supply, demand, pricing, innovation, and regulation within the healthcare industry. Clinical laboratory tests encompass a wide range of diagnostic procedures used to analyze samples such as blood, urine, tissue, and other bodily fluids to assess a patient's health status, detect diseases, monitor treatment efficacy, and guide medical decision-making.

Supply in this market is driven by advancements in medical technology, laboratory instrumentation, and reagent manufacturing capabilities. Companies specializing in diagnostic testing invest in research and development to develop new tests, improve existing methodologies, and enhance the performance and reliability of laboratory equipment and reagents. Additionally, stringent regulatory standards ensure that laboratory tests meet quality control and accuracy requirements before being used in clinical practice, ensuring a steady supply of reliable diagnostic solutions.

On the demand side, several factors contribute to the need for clinical laboratory tests. The increasing prevalence of chronic diseases, infectious diseases, and cancer drives the demand for diagnostic testing to facilitate early detection, diagnosis, and monitoring of these conditions. Moreover, aging populations, lifestyle changes, and advances in personalized medicine create new opportunities for diagnostic testing to tailor treatments to individual patients' needs and optimize healthcare outcomes.

Pricing dynamics in the clinical laboratory test market are influenced by factors such as test complexity, volume, reimbursement policies, and competition among testing providers. Advanced molecular and genetic tests may command higher prices due to their specialized expertise, technical requirements, and unique insights into disease biology. However, pricing pressures from healthcare payers, including government agencies, insurers, and healthcare providers, may constrain reimbursement rates, impacting the profitability and sustainability of laboratory testing services.

Innovation plays a crucial role in shaping the market dynamics of clinical laboratory tests. Companies invest in research and development to develop novel biomarkers, assays, and testing methodologies that offer improved sensitivity, specificity, and turnaround times. Technological advancements such as automation, digitalization, and point-of-care testing enable laboratories to increase testing throughput, reduce errors, and enhance operational efficiency, driving innovation within the industry and expanding the scope of laboratory testing services.

Regulatory compliance is a significant consideration for companies operating in the clinical laboratory test market. Clinical laboratory tests are subject to regulatory oversight by agencies such as the FDA in the United States and similar authorities worldwide. Compliance with regulatory requirements ensures the safety, accuracy, and reliability of laboratory tests, instilling confidence in healthcare providers and patients.

Market competition in the clinical laboratory test industry is intense, with several established players and emerging companies vying for market share. National and regional reference laboratories leverage their scale, infrastructure, and network of testing facilities to maintain a competitive edge. Meanwhile, specialized laboratories focus on niche markets, innovative testing technologies, and strategic partnerships to differentiate themselves and gain market traction.

Geopolitical factors also influence the market dynamics of clinical laboratory tests. Healthcare policies, government funding, and public health initiatives impact the demand for diagnostic testing and the reimbursement landscape in different regions. Moreover, regional variations in disease prevalence, healthcare infrastructure, and regulatory environments create diverse market conditions and opportunities for testing providers.

Leave a Comment