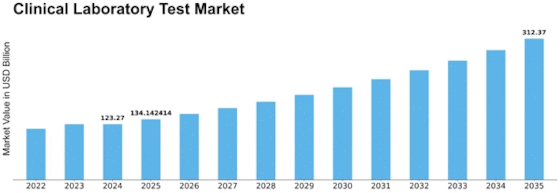

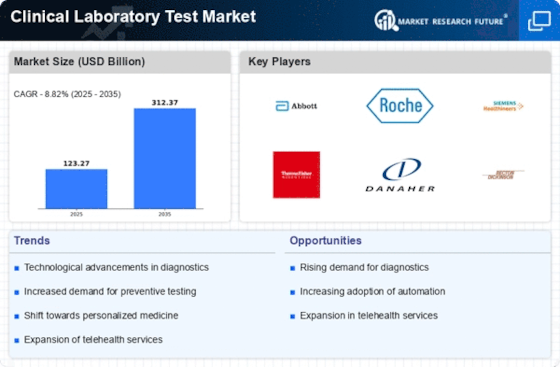

Clinical Laboratory Test Size

Clinical Laboratory Test Market Growth Projections and Opportunities

The clinical laboratory test market is a fundamental component of modern healthcare, providing essential diagnostic information to guide medical decisions, monitor disease progression, and evaluate treatment efficacy. This market segment encompasses a wide range of laboratory tests, including blood tests, urine tests, genetic tests, microbiology tests, and imaging tests, which are performed on various biological samples collected from patients. Clinical laboratory tests play a crucial role in the diagnosis and management of a broad spectrum of medical conditions, from infectious diseases and cancer to metabolic disorders and cardiovascular diseases.

Blood tests are among the most common types of clinical laboratory tests and are used to assess various parameters such as blood cell counts, glucose levels, lipid profiles, and markers of organ function. These tests can help diagnose conditions such as anemia, diabetes, liver disease, and kidney dysfunction, providing valuable insights into a patient's overall health status. Urine tests, on the other hand, are used to evaluate kidney function, detect urinary tract infections, and screen for metabolic disorders such as diabetes and kidney stones.

Genetic tests have become increasingly important in clinical practice, allowing healthcare providers to assess an individual's risk of inherited diseases, guide personalized treatment decisions, and inform reproductive planning. These tests can identify mutations or variations in specific genes associated with hereditary conditions such as cancer, cardiovascular disease, and neurological disorders, enabling early intervention and targeted therapies. Microbiology tests play a critical role in the diagnosis and management of infectious diseases, allowing healthcare providers to identify the causative agents of infections, determine their susceptibility to antimicrobial agents, and guide appropriate treatment strategies.

Imaging tests, including X-rays, computed tomography (CT) scans, magnetic resonance imaging (MRI), and ultrasound, provide detailed anatomical and functional information to aid in the diagnosis and staging of various medical conditions. These tests are used to visualize internal organs, tissues, and structures, identify abnormalities such as tumors, fractures, and inflammation, and monitor disease progression over time. Advances in imaging technology, such as high-resolution imaging, contrast-enhanced imaging, and functional imaging techniques, have improved the sensitivity and specificity of diagnostic tests, leading to earlier detection and more accurate diagnosis of diseases.

The clinical laboratory test market is driven by several factors, including the increasing prevalence of chronic diseases, the growing demand for personalized medicine, advancements in diagnostic technology, and the expansion of healthcare infrastructure. As the global burden of chronic diseases such as diabetes, cardiovascular disease, and cancer continues to rise, there is a growing need for diagnostic tests that can facilitate early detection, risk stratification, and targeted therapy. Additionally, with the emergence of precision medicine approaches that tailor treatments to individual patient characteristics, there is a growing demand for genetic tests and molecular diagnostics that can provide actionable insights into disease mechanisms and treatment response.

Technological advancements are driving innovation in the clinical laboratory test market, with emerging trends such as point-of-care testing, liquid biopsy, and digital pathology transforming the landscape of diagnostic testing. Point-of-care testing (POCT) enables rapid and convenient access to diagnostic information at the point of care, reducing turnaround times, facilitating timely clinical decision-making, and improving patient outcomes. Liquid biopsy techniques, such as circulating tumor DNA (ctDNA) analysis, allow for non-invasive detection and monitoring of cancer biomarkers in blood samples, offering a minimally invasive alternative to traditional tissue biopsies. Digital pathology platforms leverage digital imaging and artificial intelligence (AI) algorithms to analyze histological specimens and provide quantitative and qualitative assessments of tissue morphology, aiding pathologists in diagnosis, prognostication, and treatment planning.

Leave a Comment