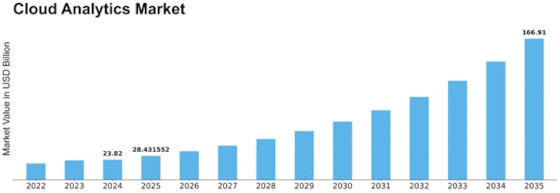

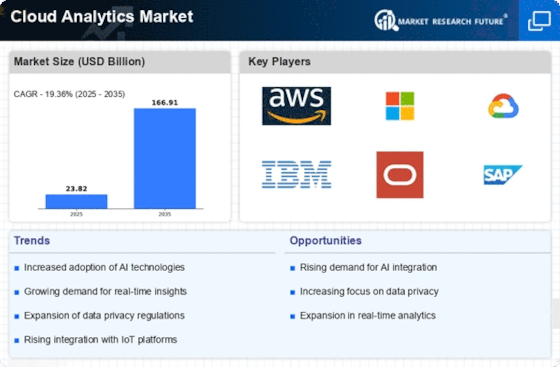

Cloud Analytics Size

Cloud Analytics Market Growth Projections and Opportunities

The Cloud Analytics market has been driven by a plethora of market forces that contribute to its growth and widespread acceptance. A very important one is the rising demand for real-time data analytics and business intelligence solutions. Additionally, the cost-effectiveness of Cloud Analytics plays a crucial role in its market dynamics. Unlike traditional on-premises analytics solutions that come with huge upfront costs for hardware, software, and maintenance, Cloud Analytics operates on a subscription-based model, eliminating the need for significant initial investments. This cost-effective approach appeals to a wide range of companies, including small and medium-sized enterprises, enabling them to access advanced analytical capabilities without an oppressive financial burden. Cloud Analytics' agility and deployment flexibility also drive market growth. Enterprises are increasingly recognizing the importance of being able to adapt quickly to varying market circumstances. It allows enterprises to adjust resources according to the needs of their business cycles so they can effectively manage fluctuations in data volumes or analytic roles. Security concerns have always impeded the adoption of cloud-based solutions like Cloud Analytics. However, advancements in cloud security protocols, as well as robust encryption methods, have significantly mitigated these issues. Sensitive information is now protected from unauthorized entry since cloud service providers heavily invest in security measures. Consequently, businesses are more comfortable leaving their information on Cloud Analytics platforms, which is propelling the industry's growth. Interoperability and integration capabilities also serve as vital determinants in this marketplace. Cloud Analytics solutions are designed for seamless integration with other data sources and existing IT infrastructure. This means that organizations can derive insights from diverse datasets, including those stored within on-premise systems, cloud databases, and external repositories. The global shift towards remote and hybrid working models is another factor shaping the Cloud Analytics market. With workforces decentralized, there is a growing demand for analytical solutions that support collaboration and provide access to insights from anywhere. Cloud analytics meets this need through openness and collaborative features, enabling teams to make informed choices regardless of their physical location.

Leave a Comment