Regulatory Compliance Pressures

The Cloud Ids Ips Market is significantly influenced by regulatory compliance pressures. Organizations are increasingly required to adhere to stringent data protection regulations, such as GDPR and HIPAA, which mandate the implementation of effective security measures. This regulatory landscape compels businesses to invest in intrusion detection and prevention systems to ensure compliance and avoid hefty fines. Recent reports suggest that non-compliance can result in penalties exceeding 4% of annual global revenue. Consequently, the Cloud Ids Ips Market is likely to see a rise in demand for solutions that facilitate compliance, as organizations prioritize risk management and legal adherence.

Expansion of Cloud Infrastructure

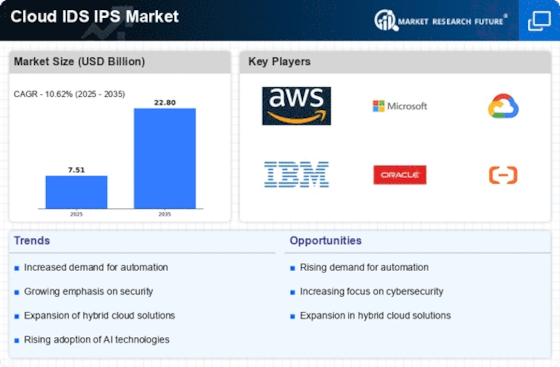

The Cloud Ids Ips Market is poised for growth due to the ongoing expansion of cloud infrastructure. As more enterprises adopt cloud computing, the demand for integrated security solutions, including intrusion detection and prevention systems, is expected to rise. Recent statistics indicate that the cloud infrastructure market is anticipated to grow at a compound annual growth rate of over 20% through 2025. This expansion creates opportunities for the Cloud Ids Ips Market to innovate and offer advanced security solutions tailored to diverse cloud environments. The increasing complexity of cloud architectures necessitates sophisticated security measures, further propelling market growth.

Increased Awareness of Cyber Threats

The Cloud Ids Ips Market is experiencing growth due to increased awareness of cyber threats among organizations. As high-profile data breaches and cyberattacks become more prevalent, businesses are recognizing the critical need for effective security solutions. This heightened awareness is driving investments in intrusion detection and prevention systems, as companies aim to protect their assets and maintain customer trust. Recent surveys indicate that over 70% of organizations consider cybersecurity a top priority, which is likely to bolster the Cloud Ids Ips Market. The ongoing evolution of cyber threats necessitates continuous innovation in security solutions, further fueling market demand.

Integration of Advanced Technologies

The Cloud Ids Ips Market is benefiting from the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the capabilities of intrusion detection and prevention systems, allowing for more accurate threat detection and response. As organizations seek to leverage these innovations, the market for cloud-based security solutions is expected to expand. Recent analyses indicate that AI-driven security solutions could reduce incident response times by up to 50%, making them highly attractive to businesses. This trend suggests that the Cloud Ids Ips Market will continue to evolve, driven by the demand for smarter, more efficient security measures.

Rising Demand for Cybersecurity Solutions

The Cloud Ids Ips Market is experiencing a notable surge in demand for cybersecurity solutions. As organizations increasingly migrate to cloud environments, the need for robust security measures becomes paramount. According to recent data, the cybersecurity market is projected to reach approximately 300 billion USD by 2025, indicating a strong correlation with the growth of cloud services. This trend suggests that businesses are prioritizing the protection of sensitive data, thereby driving investments in intrusion detection and prevention systems. The Cloud Ids Ips Market is likely to benefit from this heightened focus on security, as companies seek to mitigate risks associated with cyber threats.

Leave a Comment