Growing Military Expenditure

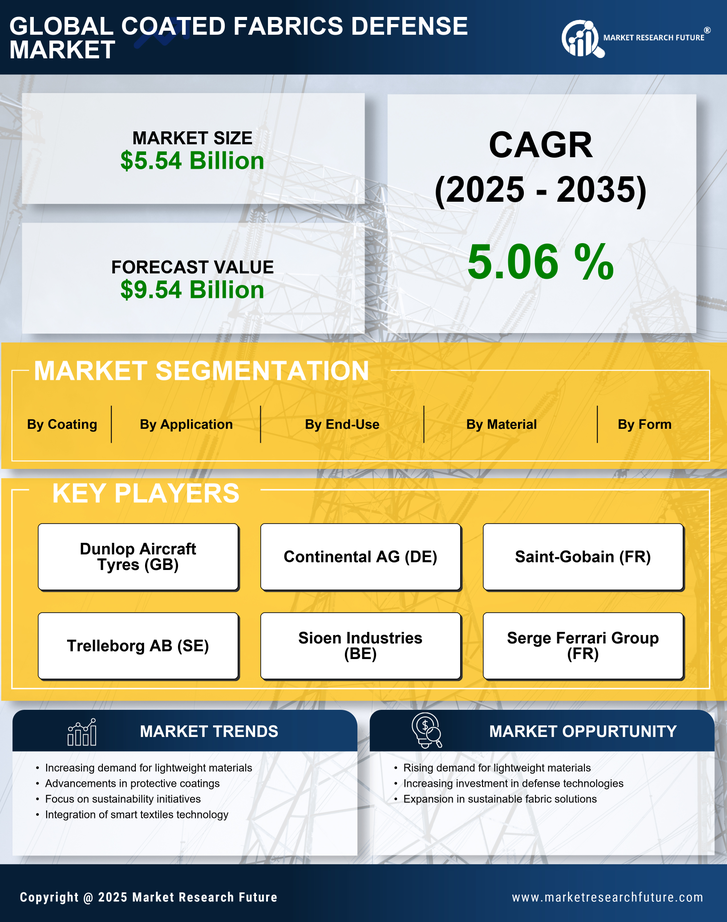

In recent years, there has been a noticeable increase in military expenditure across various nations, which is likely to bolster the Coated Fabrics Defense Market. Governments are prioritizing modernization and upgrading their defense capabilities, leading to heightened demand for advanced materials, including coated fabrics. According to recent reports, military budgets are projected to grow by approximately 3-5% annually, with a significant portion allocated to procurement of new equipment and materials. This trend suggests that defense contractors will increasingly seek high-performance coated fabrics to meet stringent requirements for durability and functionality. As a result, the Coated Fabrics Defense Market stands to benefit from this upward trajectory in defense spending, potentially leading to increased market opportunities for manufacturers.

Sustainability and Eco-Friendly Materials

The Coated Fabrics Defense Market is increasingly influenced by sustainability trends, as defense organizations seek to adopt eco-friendly materials. The push for greener solutions is prompting manufacturers to explore biodegradable and recyclable coated fabrics, which can reduce the environmental impact of defense operations. This shift is not merely a trend but appears to be a strategic response to regulatory pressures and public demand for sustainable practices. Companies that invest in developing eco-friendly coated fabrics may find themselves at a competitive advantage, as they align with the growing emphasis on corporate social responsibility. Furthermore, the integration of sustainable materials into defense applications could enhance the reputation of military organizations, suggesting a potential for increased market share in the Coated Fabrics Defense Market.

Emerging Markets and Defense Collaborations

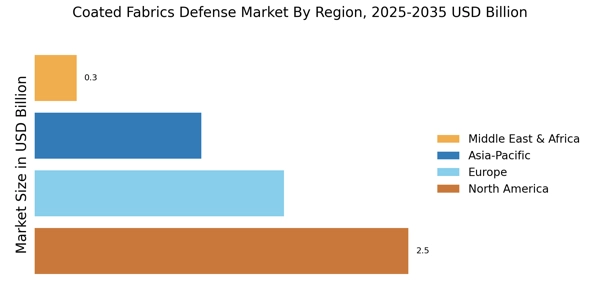

Emerging markets are increasingly becoming focal points for defense collaborations, which may positively impact the Coated Fabrics Defense Market. Countries with developing defense sectors are seeking partnerships with established manufacturers to enhance their capabilities. This trend is likely to lead to increased demand for coated fabrics, as these nations modernize their military equipment and infrastructure. Collaborative efforts may also result in the sharing of advanced technologies and materials, further driving innovation within the industry. As these markets expand, they present lucrative opportunities for coated fabric manufacturers to establish a presence and cater to the unique needs of diverse defense applications. This dynamic suggests a promising outlook for the Coated Fabrics Defense Market in the coming years.

Technological Innovations in Coated Fabrics

The Coated Fabrics Defense Market is experiencing a surge in technological innovations that enhance the performance and durability of coated fabrics. Advanced coating techniques, such as nanotechnology and polymer modifications, are being developed to improve resistance to environmental factors, thereby extending the lifespan of defense materials. For instance, the introduction of lightweight, high-strength fabrics has the potential to revolutionize military applications, offering better protection without compromising mobility. Furthermore, the integration of smart textiles, which can monitor environmental conditions and provide real-time data, is likely to gain traction. This trend indicates a shift towards more sophisticated materials that meet the evolving demands of defense operations, suggesting that companies investing in R&D may gain a competitive edge in the Coated Fabrics Defense Market.

Rising Focus on Personal Protective Equipment

The emphasis on personal protective equipment (PPE) within the defense sector is becoming increasingly pronounced, which may drive growth in the Coated Fabrics Defense Market. As military personnel face diverse threats, the demand for specialized fabrics that offer protection against chemical, biological, and ballistic hazards is on the rise. Coated fabrics are integral to the development of advanced PPE, providing essential features such as water resistance, breathability, and durability. The market for military PPE is expected to expand significantly, with estimates suggesting a compound annual growth rate of around 6% over the next few years. This growth indicates a robust opportunity for manufacturers of coated fabrics to innovate and supply materials that meet the stringent safety standards required in defense applications.