Market Growth Projections

The Global Coated Fabrics Market Industry is poised for substantial growth, with projections indicating a market value of 36.1 USD Billion in 2024 and an anticipated increase to 57.1 USD Billion by 2035. This growth trajectory suggests a CAGR of 4.26% from 2025 to 2035, reflecting the industry's resilience and adaptability to changing consumer demands. Various sectors, including automotive, protective clothing, and furniture, are expected to contribute to this growth, highlighting the diverse applications of coated fabrics. The evolving landscape of coated fabrics signifies a promising future for the industry.

Growth in Protective Clothing

The Global Coated Fabrics Market Industry is significantly influenced by the expanding use of coated fabrics in protective clothing. Industries such as construction, healthcare, and manufacturing increasingly require garments that offer protection against hazardous conditions. Coated fabrics provide essential features such as waterproofing, flame resistance, and chemical protection, making them ideal for safety apparel. The rising awareness of occupational safety standards and regulations further propels this trend. As a result, the demand for coated fabrics in protective clothing is expected to bolster market growth, aligning with the overall trajectory of the industry.

Emerging Markets and Urbanization

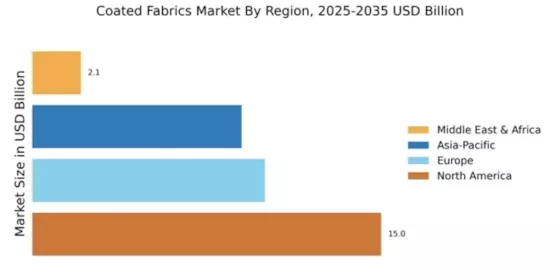

Emerging markets and urbanization are pivotal drivers of the Global Coated Fabrics Market Industry. As urban populations grow, there is an increasing need for infrastructure development, which in turn drives demand for coated fabrics in construction and transportation applications. Countries in Asia-Pacific and Latin America are witnessing rapid urbanization, leading to heightened investments in public infrastructure and housing. This trend is likely to create new opportunities for coated fabrics, as they are essential in various applications, including tents, tarpaulins, and awnings. The market's expansion in these regions may significantly influence global growth patterns.

Rising Demand in Automotive Sector

The Global Coated Fabrics Market Industry experiences a notable surge in demand from the automotive sector, driven by the need for durable and lightweight materials. Coated fabrics are increasingly utilized in vehicle interiors, including seats, headliners, and dashboards, due to their resistance to wear and tear. In 2024, the market is projected to reach 36.1 USD Billion, reflecting the automotive industry's shift towards enhanced aesthetics and functionality. As manufacturers prioritize quality and performance, the adoption of advanced coated fabrics is likely to grow, contributing to a projected CAGR of 4.26% from 2025 to 2035.

Technological Advancements in Coating Processes

Technological advancements in coating processes are reshaping the Global Coated Fabrics Market Industry. Innovations such as nanotechnology and eco-friendly coatings enhance the performance and sustainability of coated fabrics. These advancements not only improve the durability and functionality of the fabrics but also cater to the growing consumer demand for environmentally responsible products. As manufacturers adopt these cutting-edge technologies, the market is likely to witness an increase in product offerings that meet diverse consumer needs. This trend may contribute to the anticipated growth of the market, with projections indicating a rise to 57.1 USD Billion by 2035.

Increasing Applications in Furniture and Upholstery

The Global Coated Fabrics Market Industry is experiencing growth due to the increasing applications of coated fabrics in furniture and upholstery. The demand for stylish, durable, and easy-to-clean materials in residential and commercial furniture is driving manufacturers to incorporate coated fabrics into their designs. These fabrics offer resistance to stains, fading, and wear, making them suitable for high-traffic areas. As consumers prioritize aesthetics and functionality in their living spaces, the market for coated fabrics in furniture is expected to expand, reflecting broader trends in home decor and design.