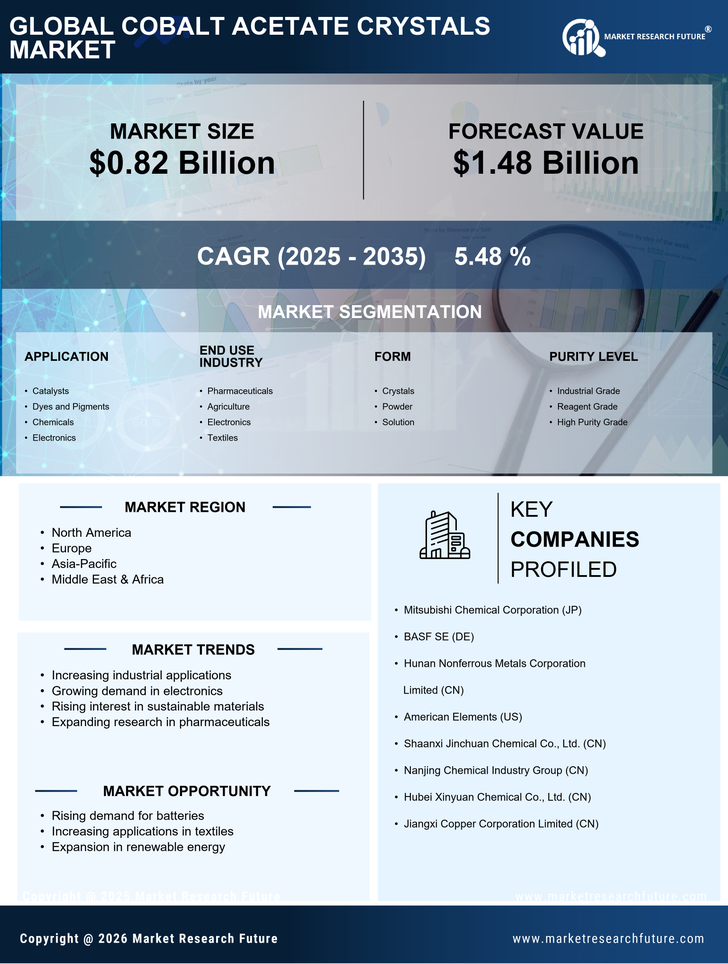

Growth in Chemical Applications

The Cobalt Acetate Crystals Market is witnessing growth driven by the expanding applications of cobalt acetate in various chemical processes. Cobalt acetate serves as a catalyst in the production of specialty chemicals, which are increasingly in demand across multiple industries, including pharmaceuticals and agriculture. The versatility of cobalt acetate allows it to be utilized in the synthesis of organic compounds, enhancing its appeal to manufacturers. Market data reveals that the chemical sector is projected to grow at a steady rate, with cobalt acetate playing a pivotal role in facilitating efficient production processes. This growth trajectory indicates a robust future for cobalt acetate crystals as industries seek reliable and effective chemical solutions.

Rising Demand in Battery Manufacturing

The Cobalt Acetate Crystals Market is experiencing a notable surge in demand due to the increasing utilization of cobalt in battery manufacturing, particularly for electric vehicles and portable electronics. As the shift towards renewable energy sources accelerates, the need for efficient energy storage solutions becomes paramount. Cobalt acetate, being a precursor in the production of cobalt-based cathodes, plays a crucial role in enhancing battery performance. Recent data indicates that the battery segment accounts for a significant portion of cobalt consumption, with projections suggesting a compound annual growth rate of over 20% in the coming years. This trend underscores the importance of cobalt acetate crystals in meeting the evolving needs of the energy sector.

Technological Innovations in Production

The Cobalt Acetate Crystals Market is benefiting from technological advancements in production methods. Innovations in synthesis techniques are enabling manufacturers to produce cobalt acetate crystals more efficiently and at a lower cost. These advancements not only improve the quality of the final product but also enhance the scalability of production processes. As industries demand higher purity levels and consistent quality, the ability to leverage cutting-edge technologies becomes increasingly important. Market analysis suggests that companies investing in research and development are likely to gain a competitive edge, positioning themselves favorably in the evolving landscape of the cobalt acetate market.

Increased Focus on Sustainable Practices

The Cobalt Acetate Crystals Market is influenced by a growing emphasis on sustainable production practices. As industries strive to reduce their environmental footprint, the demand for eco-friendly materials has intensified. Cobalt acetate, when sourced responsibly, can contribute to sustainable manufacturing processes. Companies are increasingly adopting practices that prioritize the use of recycled materials and minimize waste, aligning with global sustainability goals. This shift not only enhances the marketability of cobalt acetate but also positions it favorably among environmentally conscious consumers. The trend towards sustainability is expected to drive innovation in the production of cobalt acetate crystals, potentially leading to new applications and market opportunities.

Regulatory Compliance and Market Adaptation

The Cobalt Acetate Crystals Market is shaped by the need for regulatory compliance and adaptation to changing market conditions. As governments implement stricter regulations regarding the use of cobalt and its compounds, manufacturers must ensure that their products meet these standards. This compliance not only affects production processes but also influences market dynamics, as companies that adapt quickly to regulatory changes can capture market share more effectively. The ongoing evolution of regulations presents both challenges and opportunities for the cobalt acetate market, as businesses that prioritize compliance are likely to enhance their reputation and foster customer trust.