Emphasis on Ethical AI Practices

The Cognitive Computing Vendor Comparison Market is increasingly shaped by the emphasis on ethical AI practices. As cognitive computing technologies evolve, concerns regarding bias, transparency, and accountability in AI systems have come to the forefront. Organizations are now more vigilant in selecting vendors that adhere to ethical guidelines and demonstrate a commitment to responsible AI development. Recent studies indicate that over 60% of consumers are concerned about the ethical implications of AI, which influences their purchasing decisions. Vendors that prioritize ethical considerations in their cognitive computing solutions are likely to resonate with organizations seeking to build trust and credibility. This trend indicates a shift in the Cognitive Computing Vendor Comparison Market towards a more conscientious approach to AI, where ethical practices are integral to vendor evaluation and selection.

Expansion of Cloud-Based Services

The Cognitive Computing Vendor Comparison Market is significantly influenced by the expansion of cloud-based services. As organizations increasingly migrate to cloud environments, the demand for cognitive computing solutions that are compatible with these platforms is on the rise. Recent data indicates that the cloud computing market is expected to reach USD 832 billion by 2025, which underscores the potential for cognitive computing vendors to capitalize on this trend. Cloud-based cognitive solutions offer scalability, flexibility, and cost-effectiveness, making them attractive to businesses of all sizes. Vendors that can effectively integrate their cognitive computing offerings with cloud services are likely to stand out in the Cognitive Computing Vendor Comparison Market. This alignment not only enhances the functionality of cognitive solutions but also addresses the growing need for remote accessibility and collaboration among teams.

Increased Focus on Data Analytics

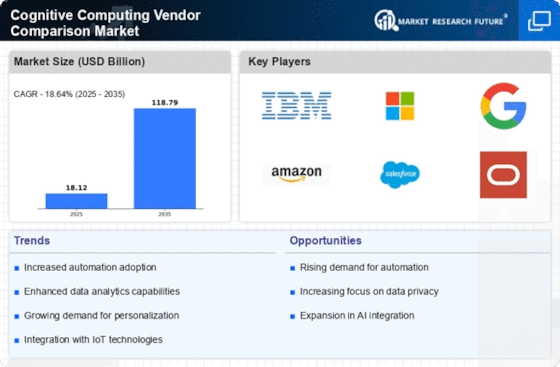

The Cognitive Computing Vendor Comparison Market is witnessing an increased focus on data analytics as organizations recognize the value of data-driven decision-making. The ability to analyze vast amounts of data in real-time is becoming essential for businesses aiming to maintain a competitive advantage. According to recent statistics, The Cognitive Computing Vendor Comparison Market is projected to grow to USD 274 billion by 2022, indicating a robust demand for cognitive computing solutions that can facilitate advanced analytics. Vendors that offer sophisticated analytics capabilities within their cognitive computing platforms are likely to attract more attention in the Cognitive Computing Vendor Comparison Market. This trend suggests that organizations are not only looking for basic cognitive functionalities but are also prioritizing vendors that can provide deep insights and predictive analytics to drive strategic initiatives.

Growing Importance of User Experience

The Cognitive Computing Vendor Comparison Market is increasingly prioritizing user experience as a critical factor in vendor selection. As cognitive computing technologies become more prevalent, the ease of use and accessibility of these solutions are paramount for organizations. Companies are seeking vendors that can deliver intuitive interfaces and seamless integration with existing systems. Recent surveys indicate that nearly 70% of users consider user experience a key determinant in their choice of cognitive computing solutions. This trend suggests that vendors who invest in enhancing user experience are likely to gain a competitive advantage in the Cognitive Computing Vendor Comparison Market. By focusing on user-centric design and functionality, vendors can foster greater adoption and satisfaction among their clients, ultimately influencing market dynamics.

Rising Demand for Automation Solutions

The Cognitive Computing Vendor Comparison Market is experiencing a notable surge in demand for automation solutions. Organizations are increasingly seeking to enhance operational efficiency and reduce human error through cognitive computing technologies. This trend is evidenced by a projected growth rate of approximately 30% in the adoption of automation tools over the next five years. As businesses strive to streamline processes, vendors that offer robust cognitive computing solutions are likely to gain a competitive edge. The integration of machine learning and natural language processing into automation frameworks is particularly appealing, as it allows for more intelligent decision-making. Consequently, the Cognitive Computing Vendor Comparison Market is witnessing a shift towards vendors that can provide comprehensive automation capabilities, thereby influencing purchasing decisions and vendor evaluations.

.png)