Technological Advancements in AGV Systems

Technological advancements are significantly influencing the Cold Storage AGV Market. Innovations in robotics, artificial intelligence, and sensor technologies are enhancing the capabilities of AGVs, making them more efficient and reliable. For instance, the introduction of advanced navigation systems allows AGVs to operate seamlessly in complex environments, reducing the risk of accidents and improving safety. Furthermore, the integration of IoT technology enables real-time monitoring and data analytics, facilitating better decision-making in cold storage operations. As these technologies continue to evolve, the Cold Storage AGV Market is likely to witness increased adoption rates, as businesses recognize the potential for improved operational efficiency and reduced costs.

Growing Emphasis on Food Safety and Compliance

The Cold Storage AGV Market is increasingly shaped by the growing emphasis on food safety and compliance regulations. As consumers become more health-conscious, the demand for safe and properly stored food products is rising. This has led to stricter regulations governing the storage and handling of perishable goods. AGVs equipped with temperature control and monitoring systems are becoming essential in maintaining compliance with these regulations. The ability to ensure consistent temperature levels during transportation within cold storage facilities is critical for preventing spoilage and ensuring product quality. Consequently, the Cold Storage AGV Market is likely to expand as businesses invest in AGV solutions that enhance food safety and regulatory compliance.

Increased Investment in Cold Chain Infrastructure

The Cold Storage AGV Market is witnessing increased investment in cold chain infrastructure. As the need for efficient cold storage solutions grows, businesses are allocating more resources to develop and upgrade their cold chain facilities. This investment is driven by the rising demand for perishable goods and the need to minimize food waste. AGVs are becoming integral to these upgraded facilities, providing automated solutions for inventory management and product handling. According to industry reports, investments in cold chain logistics are expected to reach unprecedented levels, further propelling the Cold Storage AGV Market forward. This trend indicates a robust future for AGV technologies in cold storage applications.

Rising Demand for Efficient Supply Chain Solutions

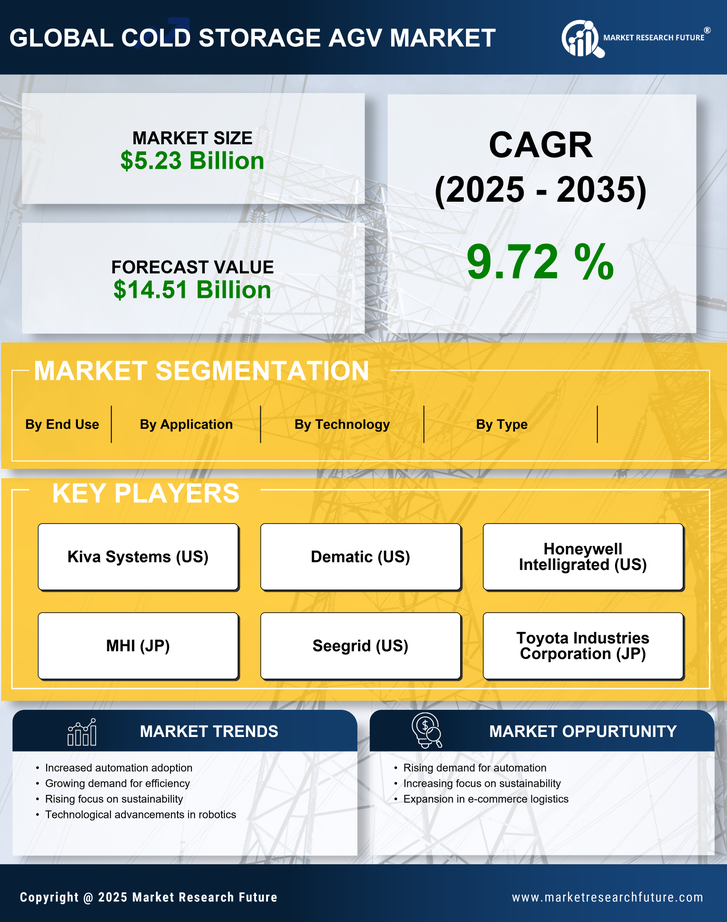

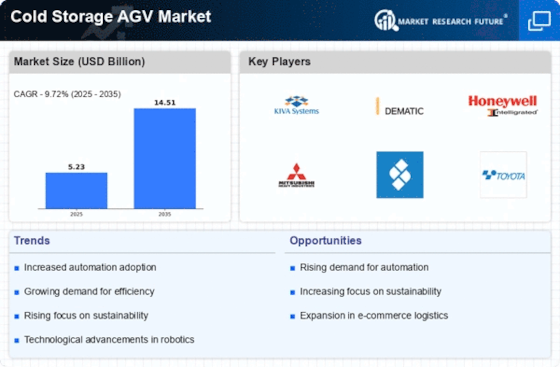

The Cold Storage AGV Market is experiencing a notable surge in demand for efficient supply chain solutions. As businesses strive to enhance operational efficiency, the integration of Automated Guided Vehicles (AGVs) in cold storage facilities has become increasingly prevalent. This trend is driven by the need to minimize labor costs and improve inventory management. According to recent data, the cold storage sector is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is indicative of the industry's shift towards automation, where AGVs play a crucial role in streamlining logistics and ensuring timely deliveries. Consequently, the Cold Storage AGV Market is poised for expansion as companies seek to optimize their supply chain processes.

Expansion of E-commerce and Online Grocery Services

The Cold Storage AGV Market is benefiting from the expansion of e-commerce and online grocery services. As consumer preferences shift towards online shopping, the demand for efficient cold storage solutions has intensified. AGVs are increasingly utilized in warehouses to facilitate the rapid movement of goods, ensuring that perishable items are delivered promptly to consumers. Recent statistics indicate that the online grocery market is expected to grow significantly, with a projected increase of over 20% in the next few years. This growth presents a substantial opportunity for the Cold Storage AGV Market, as businesses seek to enhance their logistics capabilities to meet the rising demand for online grocery deliveries.