Rising Demand for Renewable Energy

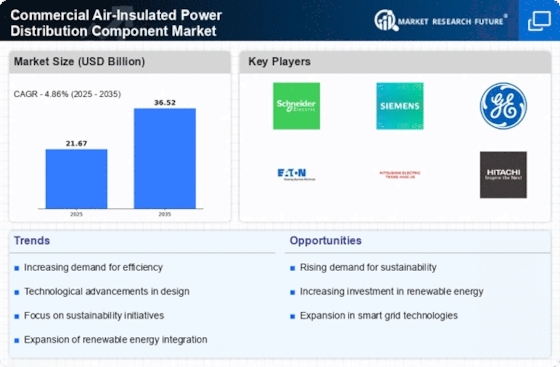

The increasing emphasis on renewable energy sources is driving the Commercial Air-Insulated Power Distribution Component Market. As nations strive to reduce carbon emissions, the integration of renewable energy into existing power grids becomes essential. This transition necessitates robust power distribution components that can handle variable energy inputs. The market for air-insulated components is projected to grow, with estimates suggesting a compound annual growth rate of around 6% over the next five years. This growth is largely attributed to the need for efficient energy distribution systems that can accommodate the influx of renewable energy, thereby enhancing grid reliability and stability.

Government Initiatives and Policies

Government initiatives aimed at enhancing energy efficiency and reliability are significantly impacting the Commercial Air-Insulated Power Distribution Component Market. Policies promoting the adoption of advanced power distribution technologies are being implemented worldwide. For instance, various governments are offering incentives for the installation of energy-efficient systems, which include air-insulated components. This regulatory support is expected to stimulate market growth, with projections indicating a potential increase in market size by 15% over the next decade. Such initiatives not only encourage the adoption of modern technologies but also align with broader sustainability goals.

Increased Investment in Smart Grids

The shift towards smart grids is a crucial driver for the Commercial Air-Insulated Power Distribution Component Market. As utilities invest in modernizing their infrastructure, the demand for advanced power distribution components rises. Smart grids facilitate better energy management, reduce losses, and improve service reliability. Recent reports indicate that investments in smart grid technologies are expected to exceed USD 200 billion by 2025. This trend underscores the importance of air-insulated components, which are integral to the efficient operation of smart grids. The growing focus on enhancing grid resilience and efficiency is likely to further propel market growth.

Urbanization and Infrastructure Development

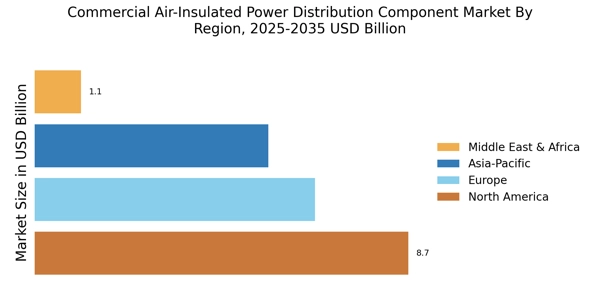

Rapid urbanization and infrastructure development are pivotal factors influencing the Commercial Air-Insulated Power Distribution Component Market. As urban areas expand, the demand for reliable power distribution systems increases. This trend is particularly evident in developing regions, where investments in infrastructure are surging. According to recent data, the urban population is expected to reach 68% by 2050, necessitating significant upgrades to power distribution networks. Air-insulated components are favored for their compact design and efficiency, making them suitable for urban environments. Consequently, this driver is likely to propel market growth as cities modernize their electrical infrastructure.

Technological Innovations in Power Distribution

Technological advancements are reshaping the Commercial Air-Insulated Power Distribution Component Market. Innovations such as smart grid technology and advanced monitoring systems enhance the efficiency and reliability of power distribution. These technologies enable real-time data analysis, allowing for proactive maintenance and reduced downtime. The market is witnessing a shift towards digital solutions, with investments in smart technologies projected to reach USD 100 billion by 2026. This trend indicates a growing preference for air-insulated components that can seamlessly integrate with modern digital infrastructure, thereby driving demand and fostering market expansion.