Growing Focus on Energy Efficiency

The emphasis on energy efficiency is increasingly shaping the Power Distribution Automation Component Market. As energy costs rise and environmental concerns mount, both consumers and utilities are prioritizing solutions that optimize energy use. Automation components play a crucial role in enhancing the efficiency of power distribution systems by enabling real-time monitoring and control. This focus on energy efficiency is further supported by initiatives aimed at reducing energy waste and promoting sustainable practices. Market analysts suggest that the demand for energy-efficient solutions will continue to drive the adoption of automation technologies, thereby expanding the market. The intersection of energy efficiency and automation is likely to yield innovative solutions that benefit both consumers and utilities.

Regulatory Support for Modernization

Regulatory frameworks are increasingly favoring the modernization of power distribution systems, thereby propelling the Power Distribution Automation Component Market. Governments are implementing policies that encourage the adoption of smart grid technologies and automation solutions to improve energy efficiency and reduce carbon emissions. For instance, various regions have set ambitious targets for renewable energy integration, which necessitates the deployment of advanced distribution automation components. This regulatory support not only facilitates the transition to smarter grids but also incentivizes utilities to invest in automation technologies, thereby expanding the market. The alignment of regulatory policies with technological advancements is likely to foster a conducive environment for market growth.

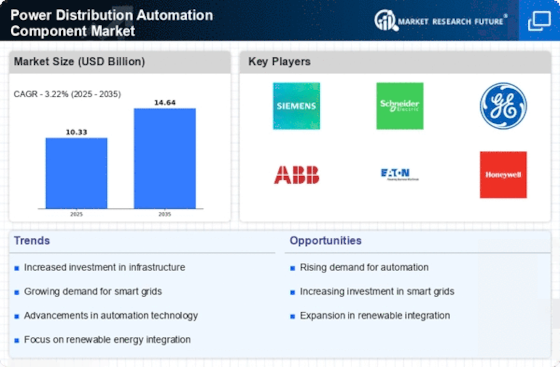

Increasing Demand for Reliable Power Supply

The Power Distribution Automation Component Market is experiencing a surge in demand for reliable power supply systems. This demand is driven by the growing need for uninterrupted electricity in residential, commercial, and industrial sectors. As urbanization accelerates, the pressure on existing power distribution networks intensifies, necessitating the adoption of automation components to enhance efficiency and reliability. According to recent data, the market for power distribution automation components is projected to grow at a compound annual growth rate of approximately 7% over the next five years. This growth is indicative of the increasing investments in infrastructure upgrades and the integration of advanced technologies to ensure a stable power supply.

Rising Investment in Smart Grid Infrastructure

Investment in smart grid infrastructure is a pivotal driver for the Power Distribution Automation Component Market. As utilities seek to modernize their aging infrastructure, there is a notable shift towards integrating automation components that enhance operational efficiency and grid reliability. Recent reports indicate that investments in smart grid technologies are expected to reach several billion dollars in the coming years, reflecting a robust commitment to upgrading power distribution systems. This influx of capital is likely to accelerate the deployment of automation solutions, thereby creating a favorable landscape for market participants. The emphasis on smart grid development underscores the critical role of automation components in achieving a resilient and efficient power distribution network.

Technological Advancements in Automation Solutions

Technological advancements are a key catalyst for growth in the Power Distribution Automation Component Market. Innovations in automation technologies, such as advanced sensors, communication systems, and data analytics, are transforming the landscape of power distribution. These advancements enable utilities to enhance grid management, improve fault detection, and optimize load balancing. As technology evolves, the capabilities of automation components are expanding, leading to increased adoption across various sectors. The market is witnessing a shift towards more sophisticated solutions that offer enhanced functionality and reliability. This trend indicates a promising future for the Power Distribution Automation Component Market, as utilities seek to leverage cutting-edge technologies to meet the demands of modern power distribution.