Power Transmission Component Market Summary

As per Market Research Future analysis, the Power Transmission Component Market Size was estimated at 79.45 USD Billion in 2024. The Power Transmission Component industry is projected to grow from 83.96 USD Billion in 2025 to 145.77 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.67% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Power Transmission Component Market is poised for substantial growth driven by technological advancements and sustainability initiatives.

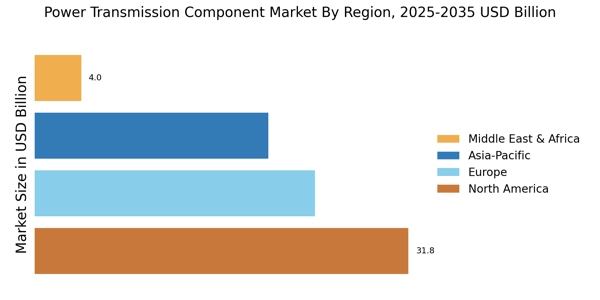

- North America remains the largest market for power transmission components, primarily due to its advanced infrastructure and technological capabilities.

- The Asia-Pacific region is currently the fastest-growing market, fueled by increasing energy demands and rapid industrialization.

- Transformers dominate the market as the largest segment, while circuit breakers are emerging as the fastest-growing segment due to their critical role in modern power systems.

- Technological advancements and sustainability initiatives are key drivers propelling market growth, alongside increasing investments in infrastructure development.

Market Size & Forecast

| 2024 Market Size | 79.45 (USD Billion) |

| 2035 Market Size | 145.77 (USD Billion) |

| CAGR (2025 - 2035) | 5.67% |