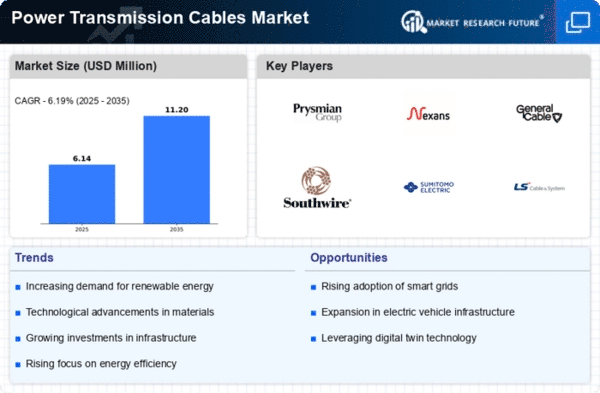

The Power Transmission Cables Market is currently characterized by a dynamic competitive landscape, driven by increasing demand for efficient energy transmission and the global shift towards renewable energy sources. Key players such as Prysmian Group (IT), Nexans (FR), and Southwire Company (US) are strategically positioning themselves through innovation and regional expansion. For instance, Prysmian Group (IT) has focused on enhancing its product portfolio with advanced cable technologies, while Nexans (FR) emphasizes sustainability in its operations, aiming to reduce carbon emissions across its supply chain. These strategies collectively shape a competitive environment that is increasingly focused on technological advancement and environmental responsibility.In terms of business tactics, companies are localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several key players exerting influence over regional markets. This fragmentation allows for a variety of competitive strategies, as companies seek to differentiate themselves through unique offerings and localized services.

In November Nexans (FR) announced a partnership with a leading renewable energy firm to develop high-capacity transmission cables specifically designed for offshore wind farms. This strategic move not only enhances Nexans' product offerings but also aligns with the growing trend towards renewable energy solutions, positioning the company favorably in a rapidly evolving market.

In October Southwire Company (US) launched a new line of environmentally friendly cables that utilize recycled materials. This initiative reflects a broader industry trend towards sustainability and demonstrates Southwire's commitment to reducing its environmental footprint. The introduction of these products is likely to attract environmentally conscious customers and strengthen the company's market position.

In September Prysmian Group (IT) completed the acquisition of a regional cable manufacturer, which is expected to enhance its production capabilities and expand its market reach in Asia. This acquisition signifies Prysmian's aggressive growth strategy and its intent to capitalize on emerging markets, thereby reinforcing its competitive edge.

As of December the competitive trends in the Power Transmission Cables Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate in order to innovate and meet evolving customer demands. The competitive differentiation is likely to shift from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability, suggesting a transformative phase for the industry.