Rising Air Travel Demand

The Commercial Aircraft Engine Market is experiencing a notable surge in demand due to the increasing number of air travelers. Projections indicate that air passenger traffic could double over the next two decades, driven by economic growth and rising disposable incomes in emerging markets. This trend necessitates the production of more aircraft, subsequently boosting the demand for advanced aircraft engines. As airlines expand their fleets to accommodate this growth, the Commercial Aircraft Engine Market is poised for significant expansion. Furthermore, the need for more fuel-efficient engines aligns with the industry's focus on sustainability, making it a critical driver for future investments and innovations.

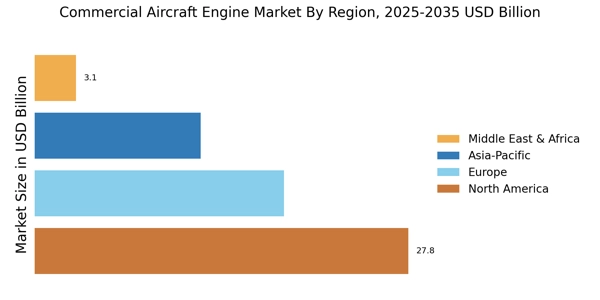

Emerging Markets and Regional Growth

The Commercial Aircraft Engine Market is witnessing growth in emerging markets, where increasing urbanization and economic development are driving air travel demand. Countries in Asia and Africa are expanding their aviation infrastructure, leading to a rise in new airline entrants and fleet expansions. This trend is expected to create substantial opportunities for engine manufacturers as they cater to the specific needs of these markets. Furthermore, regional players are entering the Commercial Aircraft Engine Market, intensifying competition and fostering innovation. As these markets continue to develop, they will play a crucial role in shaping the future landscape of the Commercial Aircraft Engine Market.

Increased Investment in Aerospace Sector

The Commercial Aircraft Engine Market is benefiting from heightened investment in the aerospace sector. Governments and private investors are channeling funds into research and development, aiming to enhance engine performance and sustainability. This influx of capital is crucial for fostering innovation and supporting the development of next-generation engines. Additionally, partnerships between manufacturers and technology firms are becoming more prevalent, facilitating the exchange of knowledge and resources. As investment continues to rise, the Commercial Aircraft Engine Market is likely to experience accelerated growth, with new technologies and products emerging to meet evolving market demands.

Technological Innovations in Engine Design

Technological advancements play a pivotal role in shaping the Commercial Aircraft Engine Market. Innovations such as the development of geared turbofan engines and advanced materials are enhancing engine performance and efficiency. These technologies contribute to reduced fuel consumption and lower operational costs for airlines. The market is witnessing a shift towards engines that incorporate digital technologies, enabling predictive maintenance and improved reliability. As airlines seek to optimize their operations, the demand for cutting-edge engine designs is likely to increase, further propelling the growth of the Commercial Aircraft Engine Market. This trend suggests a continuous cycle of innovation and improvement within the sector.

Regulatory Compliance and Emission Standards

The Commercial Aircraft Engine Market is significantly influenced by stringent regulatory frameworks aimed at reducing aviation emissions. Governments and international bodies are increasingly implementing regulations that mandate lower emissions and improved fuel efficiency. For instance, the International Civil Aviation Organization has set ambitious targets for carbon neutrality by 2050. This regulatory landscape compels manufacturers to innovate and develop engines that meet these standards, thereby driving growth in the Commercial Aircraft Engine Market. The need for compliance not only fosters technological advancements but also encourages investment in research and development, ensuring that the industry remains competitive and sustainable.

.png)