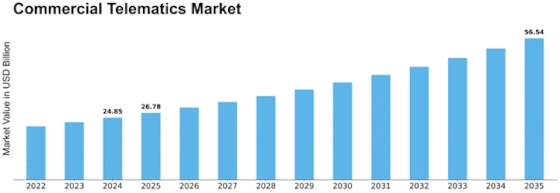

Commercial Telematics Size

Commercial Telematics Market Growth Projections and Opportunities

The Commercial Telematics Market is a vibrant and fast-growing sector that is critical to modern business. It remains a dynamic market. The combination of telecommunications and informatics, known as telematics, has brought about remote monitoring and communication for cars and other assets. Several factors are driving the growth of this market, one of which is the increasing demand for real-time data and insights. For this reason, businesses can get an in-depth understanding of their fleets through telematics solutions such as performance-based levels, fuel efficiency, and maintenance requirements. Consequently, firms adopt a data-driven approach that leads them to informed decision-making, thus leading to better productivity and efficiency. Such developments have seen greater adoption of telematic solutions within sectors like logistics, transport, and construction. Additionally, state-of-the-art technologies like GPS (Global Positioning Systems), IoT (Internet of Things), or AI (Artificial Intelligence) have also had an impact on the dynamics of this market segment. Henceforth, along with vehicle health information and route optimization tips, these systems do more than track locations; they give out actionable driver behavior insights, too. Moreover, there is commercial application by organizations due to safety regulations as well as environmental conservation measures, thereby fostering the use of telematics. Governments across nations make certain rules that guarantee road users' welfare while considering the impact transportation has on the environment. These regulations can be adhered to by enabling businesses to track any driving conduct, emissions, or even vehicle servicing activities; hence, they may not incur penalties again, which could boost their corporate responsibility initiatives. The commercial Telematic Market is shifting towards more integrated customized solutions. As markets mature, so does the importance directed toward data security and privacy, which become critical issues on which they rely. With countless numbers of devices connected today generating huge volumes of information from telematic systems, confidentiality + integrity must always be assured." Competitive Landscape in Commercial Telematic Market features large technology companies as well as niche startups. Furthermore, the Commercial Telematic Market will continue to grow more in the future owing to technological advancements that will revolutionize the sector. Therefore, through the integration of 5G connectivity, telematic capabilities are set for a revolution whereby vehicles can communicate with central systems much faster and more reliably.

Leave a Comment