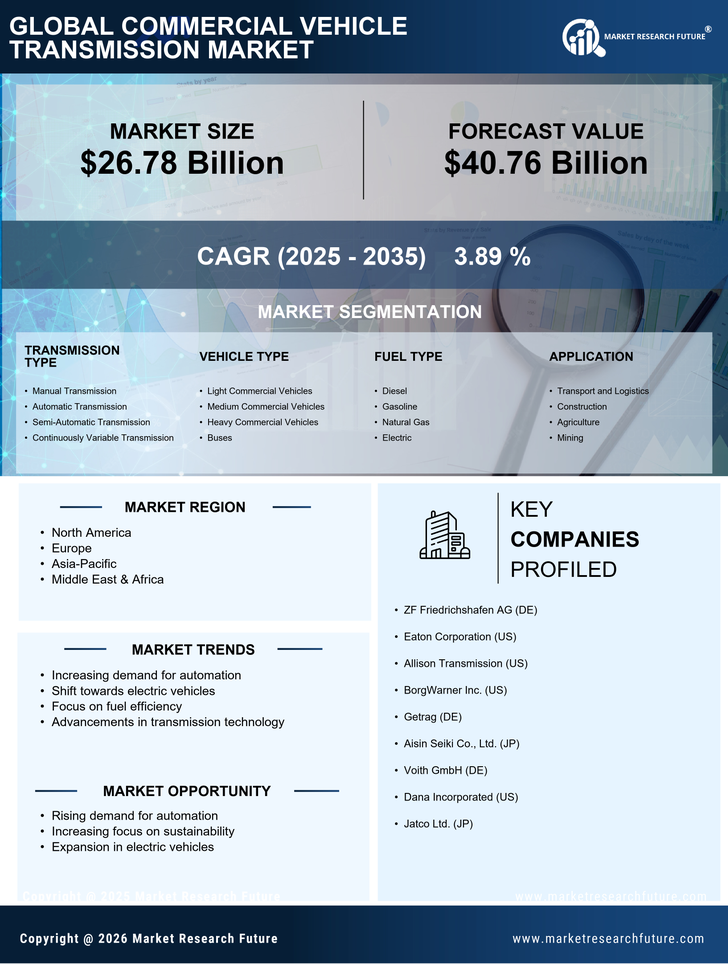

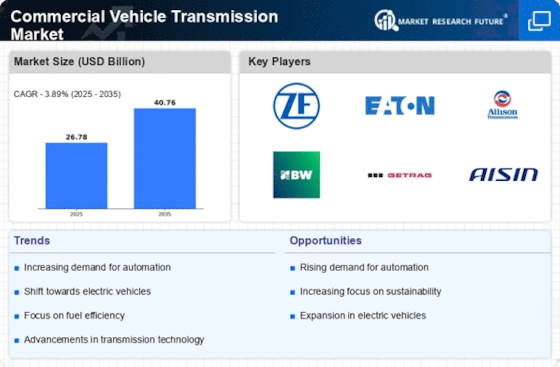

Increasing Demand for Fuel Efficiency

The Commercial Vehicle Transmission Market is experiencing a notable shift towards fuel efficiency, driven by rising fuel costs and environmental concerns. Manufacturers are increasingly focusing on developing advanced transmission systems that enhance fuel economy. For instance, the integration of automated manual transmissions (AMTs) has been shown to improve fuel efficiency by up to 10% compared to traditional systems. This trend is further supported by regulatory frameworks that encourage the adoption of fuel-efficient technologies. As a result, the demand for innovative transmission solutions is expected to grow, propelling the Commercial Vehicle Transmission Market forward.

Expansion of E-commerce and Logistics Sector

The rapid expansion of the e-commerce and logistics sector is significantly influencing the Commercial Vehicle Transmission Market. As online shopping continues to grow, the demand for commercial vehicles equipped with advanced transmission systems is on the rise. Efficient transmission systems are essential for optimizing delivery times and reducing operational costs. Reports indicate that the logistics sector is expected to grow by 20% over the next five years, thereby increasing the need for reliable and efficient commercial vehicles. This trend is likely to drive investments in the Commercial Vehicle Transmission Market, as companies seek to enhance their fleet capabilities.

Focus on Sustainability and Emission Reduction

Sustainability has become a central theme in the Commercial Vehicle Transmission Market, with manufacturers striving to reduce emissions and environmental impact. The push for greener technologies is prompting the development of hybrid and electric vehicle transmissions, which are designed to minimize carbon footprints. Regulatory bodies are also imposing stricter emission standards, compelling manufacturers to innovate. The market for electric vehicle transmissions is projected to grow at a compound annual growth rate (CAGR) of 25% over the next decade, reflecting the industry's commitment to sustainability. This focus on eco-friendly solutions is likely to reshape the Commercial Vehicle Transmission Market.

Rising Urbanization and Infrastructure Development

Urbanization and infrastructure development are key drivers of the Commercial Vehicle Transmission Market. As cities expand, the demand for commercial vehicles capable of navigating urban environments efficiently is increasing. This trend necessitates the development of transmission systems that can handle stop-and-go traffic and varying road conditions. Additionally, government investments in infrastructure projects are expected to boost the demand for heavy-duty commercial vehicles, which often require advanced transmission technologies. Analysts predict that the urbanization trend will contribute to a 30% increase in the demand for commercial vehicles over the next five years, thereby positively impacting the Commercial Vehicle Transmission Market.

Technological Advancements in Transmission Systems

Technological innovation plays a pivotal role in shaping the Commercial Vehicle Transmission Market. The advent of smart transmission systems, which utilize artificial intelligence and machine learning, is revolutionizing how vehicles operate. These systems can adapt to driving conditions in real-time, optimizing performance and efficiency. Furthermore, the market has seen a surge in the development of dual-clutch transmissions (DCTs), which offer faster gear shifts and improved acceleration. According to industry reports, the adoption of such technologies is projected to increase by 15% annually, indicating a robust growth trajectory for the Commercial Vehicle Transmission Market.