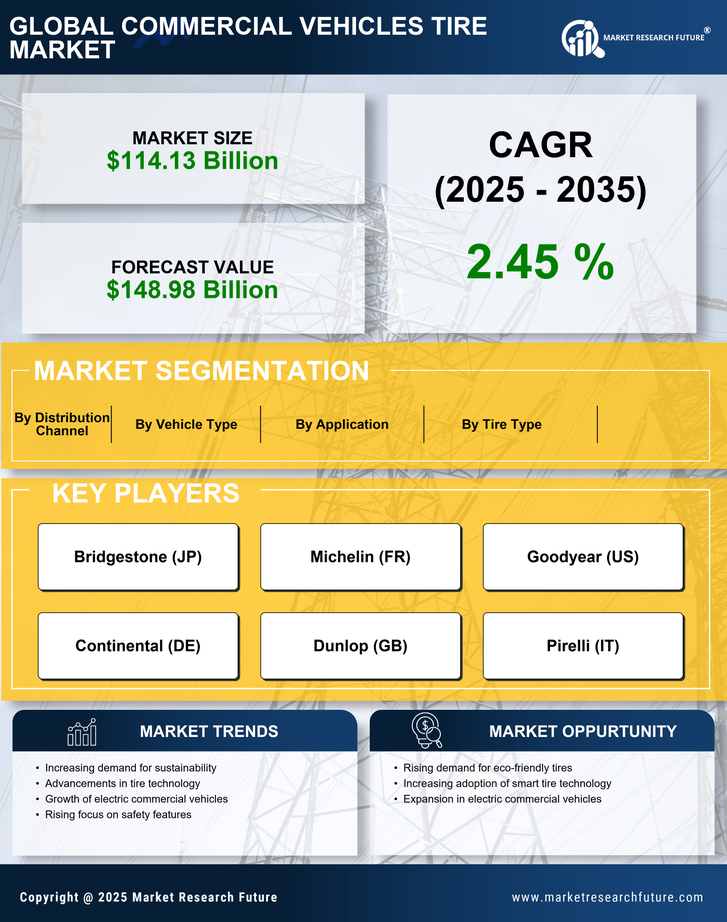

Infrastructure Development Projects

Infrastructure development projects are significantly influencing the Commercial Vehicles Tire Market. Governments and private sectors are investing heavily in road construction and maintenance, which directly impacts the demand for commercial vehicles. As new roads are built and existing ones are upgraded, the need for commercial vehicles, and consequently their tires, is expected to increase. In 2025, it is anticipated that infrastructure spending will reach unprecedented levels, potentially exceeding 1 trillion dollars. This surge in infrastructure projects is likely to create a robust market for tires designed for various terrains and conditions, thereby driving innovation and competition among manufacturers.

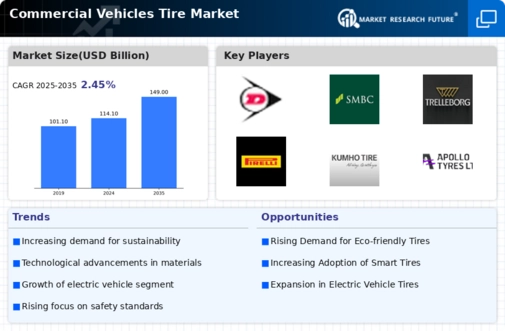

Growth of Electric Commercial Vehicles

The growth of electric commercial vehicles is emerging as a transformative driver in the Commercial Vehicles Tire Market. As more companies transition to electric fleets to reduce their carbon footprint, the demand for specialized tires designed for electric vehicles is increasing. These tires must accommodate the unique weight distribution and torque characteristics of electric vehicles, which differ from traditional combustion engines. In 2025, the electric commercial vehicle segment is expected to grow by over 15%, prompting tire manufacturers to innovate and develop products that cater specifically to this market. This shift not only presents opportunities for growth but also challenges for manufacturers to adapt to new requirements.

Rising Demand for E-commerce Logistics

The increasing demand for e-commerce logistics is a pivotal driver in the Commercial Vehicles Tire Market. As online shopping continues to surge, logistics companies are expanding their fleets to meet consumer expectations for rapid delivery. This expansion necessitates a corresponding increase in tire production and innovation, as tires must support heavier loads and longer distances. In 2025, the logistics sector is projected to account for a substantial portion of tire sales, with estimates suggesting that the demand for commercial vehicle tires could rise by 8% annually. Consequently, manufacturers are focusing on developing tires that enhance fuel efficiency and durability, thereby addressing the evolving needs of the logistics industry.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent, thereby driving the Commercial Vehicles Tire Market. Governments worldwide are implementing regulations aimed at enhancing road safety and reducing emissions. These regulations often require commercial vehicles to be equipped with specific types of tires that meet safety and environmental standards. In 2025, it is expected that compliance with these regulations will necessitate the replacement of older tires with newer, more efficient models. This shift could lead to a market growth rate of approximately 6% as companies invest in high-quality tires that not only comply with regulations but also improve overall vehicle performance.

Technological Innovations in Tire Manufacturing

Technological innovations in tire manufacturing are reshaping the Commercial Vehicles Tire Market. Advances in materials science and manufacturing processes are enabling the production of tires that are lighter, more durable, and more fuel-efficient. In 2025, it is projected that the adoption of smart tire technologies, such as sensors that monitor tire pressure and temperature, will become more prevalent. These innovations not only enhance safety but also contribute to cost savings for fleet operators. As a result, manufacturers are likely to invest heavily in research and development to create next-generation tires that meet the demands of modern commercial vehicles.