Rising Demand for Commercial Vehicles

The increasing demand for commercial vehicles in various sectors such as logistics, construction, and transportation is a primary driver of the Global US Commercial Tire Market Industry. As businesses expand and e-commerce continues to thrive, the need for efficient transportation solutions grows. This trend is reflected in the projected market size of 30.5 USD Billion in 2024, indicating a robust demand for tires that can withstand heavy loads and diverse terrains. The growth in commercial vehicle registrations further supports this trend, suggesting a sustained increase in tire sales as fleet operators seek to optimize performance and reduce operational costs.

Market Dynamics and Competitive Landscape

The competitive landscape of the Global US Commercial Tire Market Industry is characterized by numerous players vying for market share. This dynamic environment fosters innovation and drives companies to enhance their product offerings. Manufacturers are increasingly focusing on developing specialized tires that cater to specific applications, such as off-road or high-performance tires. Additionally, strategic partnerships and collaborations among industry players are becoming more common, further intensifying competition. As companies strive to differentiate themselves, the market is expected to witness sustained growth, aligning with the overall upward trend in the commercial tire sector.

Technological Advancements in Tire Manufacturing

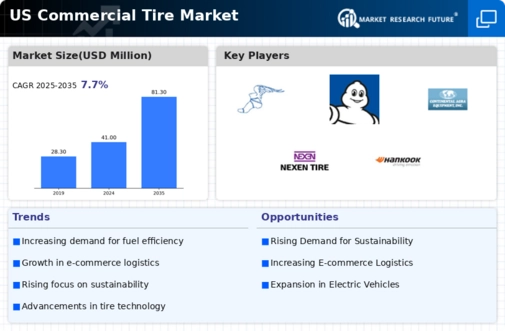

Technological innovations in tire manufacturing are significantly influencing the Global US Commercial Tire Market Industry. Advanced materials and manufacturing processes enhance tire durability, fuel efficiency, and safety. For instance, the introduction of smart tires equipped with sensors allows for real-time monitoring of tire conditions, leading to improved maintenance practices. These advancements not only extend the lifespan of tires but also contribute to cost savings for fleet operators. As the industry embraces these technologies, the market is expected to grow, with a projected CAGR of 3.64% from 2025 to 2035, reflecting the ongoing evolution in tire design and functionality.

Regulatory Compliance and Environmental Standards

Stringent regulatory compliance and environmental standards are driving changes in the Global US Commercial Tire Market Industry. Governments are increasingly mandating the use of eco-friendly materials and practices in tire production to reduce environmental impact. This shift encourages manufacturers to innovate and develop sustainable tire solutions that meet these regulations. As a result, the market is likely to see a rise in demand for tires that not only comply with regulations but also appeal to environmentally conscious consumers. This trend aligns with the projected market growth, reaching 45.2 USD Billion by 2035, as businesses adapt to evolving regulatory landscapes.

Growth of E-commerce and Last-Mile Delivery Services

The rapid growth of e-commerce and the subsequent rise in last-mile delivery services are pivotal factors in the Global US Commercial Tire Market Industry. As online shopping becomes increasingly prevalent, logistics companies are expanding their fleets to meet consumer demands for faster delivery times. This expansion necessitates a corresponding increase in tire purchases, particularly for light and medium-duty vehicles. The market's growth trajectory is evident, with a forecasted increase to 45.2 USD Billion by 2035, driven by the need for reliable and efficient tire solutions that support the logistics sector's evolving requirements.