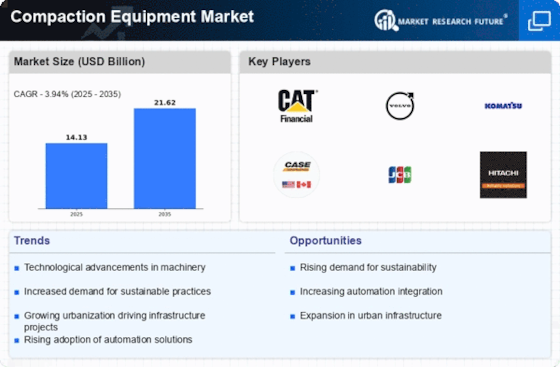

Urbanization Trends

Urbanization is a significant driver of the Compaction Equipment Market, as more people migrate to urban areas, necessitating extensive infrastructure development. The rapid growth of cities is leading to increased construction of residential, commercial, and industrial facilities, which in turn drives the demand for compaction equipment. In 2025, urban areas are projected to house over 60% of the global population, creating a pressing need for efficient compaction solutions to support infrastructure projects. This trend is likely to prompt manufacturers to develop specialized equipment tailored to urban construction challenges, thereby enhancing their market presence and competitiveness.

Technological Innovations

Technological advancements are transforming the Compaction Equipment Market, leading to the development of more efficient and environmentally friendly machinery. Innovations such as GPS technology, telematics, and automated compaction systems are enhancing the performance and accuracy of compaction equipment. In 2025, the market for smart compaction equipment is expected to grow, driven by the increasing demand for precision in construction processes. These technologies not only improve operational efficiency but also reduce fuel consumption and emissions, aligning with sustainability goals. As a result, companies that invest in these innovations are likely to gain a competitive edge in the evolving market landscape.

Rising Construction Activities

The Compaction Equipment Market is experiencing a surge due to increasing construction activities across various sectors. As urban areas expand and infrastructure projects gain momentum, the demand for compaction equipment is likely to rise. In 2025, the construction sector is projected to grow at a rate of approximately 5.5% annually, which could lead to heightened investments in compaction machinery. This growth is driven by the need for efficient soil compaction in road construction, building foundations, and other civil engineering projects. Consequently, manufacturers are focusing on developing advanced compaction equipment that meets the evolving needs of the construction industry, thereby enhancing productivity and efficiency.

Government Infrastructure Investments

Government initiatives aimed at enhancing infrastructure are playing a pivotal role in the Compaction Equipment Market. Many countries are allocating substantial budgets for infrastructure development, which includes roads, bridges, and public facilities. For instance, in 2025, it is estimated that infrastructure spending could reach trillions of dollars, creating a robust demand for compaction equipment. These investments not only stimulate economic growth but also necessitate the use of advanced compaction technologies to ensure the durability and stability of constructed facilities. As a result, the compaction equipment sector is likely to benefit significantly from these government-led projects.

Increased Demand for Sustainable Practices

The Compaction Equipment Market is witnessing a shift towards sustainable practices, driven by growing environmental concerns. Companies are increasingly adopting eco-friendly compaction equipment that minimizes carbon footprints and adheres to stringent environmental regulations. In 2025, the market for sustainable compaction solutions is projected to expand as more construction firms prioritize green building practices. This trend is likely to encourage manufacturers to innovate and produce equipment that utilizes alternative fuels and energy-efficient technologies. Consequently, the demand for sustainable compaction equipment is expected to rise, reflecting a broader commitment to environmental stewardship within the construction sector.

.png)