Increased Investment in Infrastructure

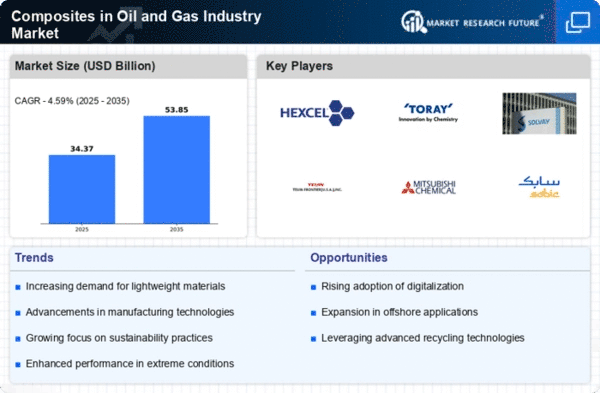

Investment in infrastructure is a key driver for the Global Composites in Oil and Gas Industry Market. Governments and private entities are allocating substantial resources to develop and upgrade oil and gas facilities, pipelines, and offshore platforms. Composites are increasingly utilized in these projects due to their corrosion resistance and durability, which are essential for long-term operational success. This trend is expected to continue, with the market projected to grow at a CAGR of 4.59% from 2025 to 2035. Such investments not only enhance operational efficiency but also contribute to the overall growth of the composites market in the sector.

Growing Demand for Lightweight Materials

The Global Composites in Oil and Gas Industry Market experiences a growing demand for lightweight materials, driven by the need for enhanced efficiency and reduced operational costs. Composites, such as carbon fiber and glass fiber reinforced polymers, offer significant weight savings compared to traditional materials. This weight reduction can lead to lower fuel consumption and increased payload capacity. As the industry seeks to optimize performance, the adoption of these materials is likely to rise. By 2024, the market is projected to reach 32.9 USD Billion, indicating a robust trend towards lightweight solutions in oil and gas applications.

Rising Exploration and Production Activities

Rising exploration and production activities in the oil and gas sector serve as a significant driver for the Global Composites in Oil and Gas Industry Market. As companies expand their operations into challenging environments, such as deepwater and Arctic regions, the demand for robust and reliable materials increases. Composites offer advantages such as resistance to harsh conditions and lower maintenance requirements, making them ideal for these applications. This trend is expected to bolster the market, as the industry continues to explore new reserves and enhance production capabilities, thereby contributing to the overall growth of the composites market.

Technological Advancements in Composite Manufacturing

Technological advancements in composite manufacturing processes significantly influence the Global Composites in Oil and Gas Industry Market. Innovations such as automated fiber placement and advanced resin infusion techniques enhance the quality and performance of composite materials. These advancements facilitate the production of complex geometries and reduce manufacturing time, making composites more accessible for various applications. As the industry embraces these technologies, the market is likely to expand, with projections indicating a rise to 53.8 USD Billion by 2035. This growth reflects the increasing reliance on advanced materials to meet the evolving demands of the oil and gas sector.

Environmental Regulations and Sustainability Initiatives

The Global Composites in Oil and Gas Industry Market is influenced by stringent environmental regulations and sustainability initiatives. As governments worldwide implement policies aimed at reducing carbon emissions and promoting sustainable practices, the oil and gas industry is compelled to adopt greener technologies. Composites, known for their lightweight and durable properties, contribute to energy efficiency and reduced environmental impact. This shift towards sustainability is likely to drive the demand for composite materials, as companies seek to comply with regulations while enhancing their operational efficiency. The market's growth is expected to align with these environmental goals.