Market Charts and Projections

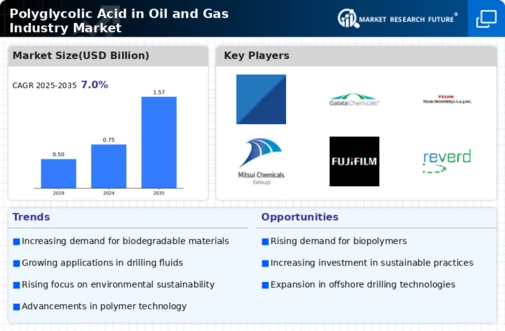

The Global Polyglycolic Acid in Oil and Gas Industry Market is projected to showcase substantial growth over the next decade. Key metrics indicate that the market size is expected to reach 0.75 USD Billion in 2024, with a significant increase to 1.57 USD Billion by 2035. The compound annual growth rate of 6.96% from 2025 to 2035 highlights the upward trajectory of this market segment. These projections underscore the increasing adoption of polyglycolic acid in various applications within the oil and gas sector, driven by technological advancements and regulatory support.

Increasing Exploration Activities

The Global Polyglycolic Acid in Oil and Gas Industry Market is bolstered by increasing exploration activities in untapped regions. As oil and gas companies expand their operations into challenging environments, the need for reliable and effective materials becomes paramount. Polyglycolic acid, with its favorable properties, is being utilized in various applications, including enhanced oil recovery and drilling operations. The growing focus on maximizing resource extraction efficiency is likely to drive demand for polyglycolic acid, contributing to the market's projected growth. This trend aligns with the overall expansion of the oil and gas sector, further solidifying polyglycolic acid's role in future developments.

Technological Advancements in Production

Technological advancements in the production of polyglycolic acid are significantly influencing the Global Polyglycolic Acid in Oil and Gas Industry Market. Innovations in polymerization processes and the development of more efficient catalysts are enhancing the yield and quality of polyglycolic acid. These improvements not only reduce production costs but also increase the material's applicability in various oil and gas operations. As a result, companies are likely to adopt polyglycolic acid more widely, fostering market growth. The anticipated compound annual growth rate of 6.96% from 2025 to 2035 underscores the potential of these advancements to reshape the industry landscape.

Rising Demand for Biodegradable Materials

The Global Polyglycolic Acid in Oil and Gas Industry Market is experiencing an upsurge in demand for biodegradable materials. As environmental regulations tighten, companies are increasingly seeking sustainable alternatives to traditional materials. Polyglycolic acid, known for its biodegradability, aligns with these sustainability goals. For instance, the oil and gas sector is exploring polyglycolic acid for applications in drilling fluids and wellbore stability, which could reduce environmental impact. This shift towards eco-friendly solutions is projected to contribute to the market's growth, with the market size expected to reach 0.75 USD Billion in 2024 and potentially 1.57 USD Billion by 2035.

Regulatory Support for Sustainable Practices

Regulatory support for sustainable practices is a key driver of the Global Polyglycolic Acid in Oil and Gas Industry Market. Governments worldwide are implementing policies that encourage the use of environmentally friendly materials in industrial applications. This regulatory landscape is prompting oil and gas companies to adopt polyglycolic acid as a viable alternative to conventional materials. The push for sustainability not only aligns with corporate social responsibility goals but also enhances operational efficiency. As the market evolves, the integration of polyglycolic acid in various applications is expected to grow, reflecting the industry's commitment to sustainable practices.