Growth of Industrial Automation

The growth of industrial automation is a key driver for the Condition Monitoring Equipment Market. As industries strive to enhance productivity and reduce operational costs, the adoption of automated systems is becoming increasingly prevalent. Condition monitoring equipment plays a crucial role in this automation journey by providing real-time insights into equipment performance and health. The market for industrial automation is projected to expand significantly, with estimates suggesting a compound annual growth rate of over 9% in the coming years. This trend indicates a robust demand for condition monitoring solutions that can seamlessly integrate with automated systems, thereby fostering market growth.

Expansion of Renewable Energy Sector

The expansion of the renewable energy sector is emerging as a significant driver for the Condition Monitoring Equipment Market. As the world shifts towards sustainable energy sources, the need for reliable monitoring of renewable energy systems, such as wind turbines and solar panels, becomes paramount. Condition monitoring equipment is essential for ensuring the optimal performance and longevity of these systems. The renewable energy market is expected to witness substantial growth, with projections indicating an increase in capacity by over 50% in the next decade. This growth presents a lucrative opportunity for condition monitoring equipment providers to cater to the evolving needs of the renewable energy sector.

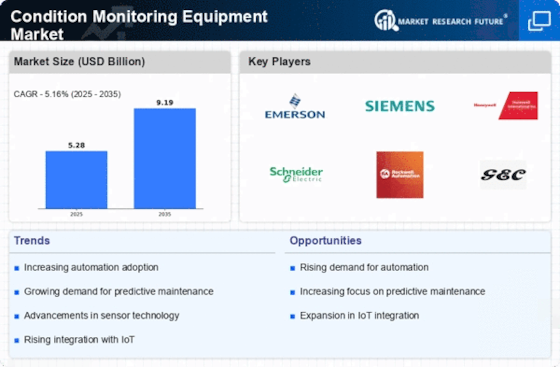

Rising Demand for Predictive Maintenance

The Condition Monitoring Equipment Market experiences a notable surge in demand for predictive maintenance solutions. Industries are increasingly recognizing the value of preventing equipment failures before they occur, which can lead to significant cost savings and enhanced operational efficiency. According to recent data, predictive maintenance can reduce maintenance costs by up to 30% and increase equipment lifespan by 20%. This trend is particularly evident in sectors such as manufacturing and energy, where unplanned downtime can result in substantial financial losses. As organizations strive to optimize their operations, the adoption of condition monitoring equipment becomes essential, driving growth in the market.

Increasing Regulatory Compliance Requirements

The Condition Monitoring Equipment Market is significantly influenced by the increasing regulatory compliance requirements across various sectors. Governments and regulatory bodies are imposing stricter guidelines to ensure safety, reliability, and environmental sustainability in industrial operations. For example, industries such as oil and gas, pharmaceuticals, and food processing are mandated to adhere to specific standards that necessitate regular monitoring of equipment conditions. This regulatory landscape compels organizations to invest in condition monitoring equipment to maintain compliance and avoid penalties. Consequently, the market is likely to witness sustained growth as companies prioritize compliance-driven investments.

Technological Advancements in Monitoring Equipment

Technological advancements play a pivotal role in shaping the Condition Monitoring Equipment Market. Innovations such as advanced sensors, machine learning algorithms, and real-time data analytics are transforming how equipment health is monitored. These technologies enable more accurate and timely assessments of equipment performance, leading to improved decision-making processes. For instance, the integration of artificial intelligence in monitoring systems allows for predictive analytics, which can forecast potential failures with remarkable precision. As industries increasingly adopt these cutting-edge technologies, the demand for sophisticated condition monitoring equipment is expected to rise, further propelling market growth.