Top Industry Leaders in the Connected Motorcycle Market

*Disclaimer: List of key companies in no particular order

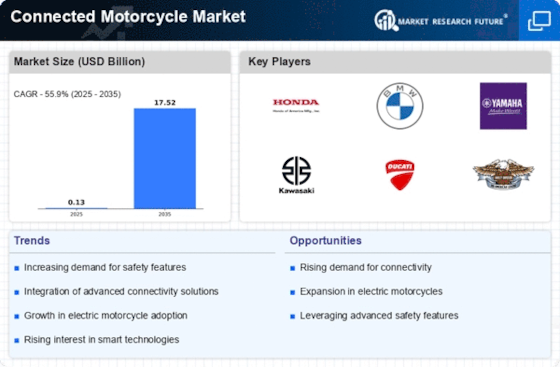

Top listed global companies in the Connected Motorcycle industry are:

Continental AG

Robert Bosch GmbH

Telit

Yamaha Motors

KTM

Ducati

Honda

Panasonic Corporation

BMW Motorrad

Harley Davidson

Bridging the Gap by Exploring the Competitive Landscape of the Connected Motorcycle Top Players

The connected motorcycle market, still in its nascent stages, is revving up for a thrilling ride. this burgeoning sector is attracting established giants and nimble startups alike, all vying for a piece of the pie. Understanding the competitive landscape is crucial for any player aiming to secure a pole position.

Key Players and Their Strategies:

- Traditional Motorcycle Manufacturers: Harley-Davidson, BMW, and Honda are leveraging their brand legacy and extensive dealer networks to introduce connected features in their premium models. Their focus lies on safety, navigation, and performance enhancement, catering to tech-savvy riders.

- Telecom Giants: Vodafone, AT&T, and Verizon are entering the fray by offering connectivity packages and data plans tailored for motorcycles. Partnering with manufacturers or directly entering the hardware space, they aim to capture the recurring revenue stream from data usage.

- Technology Companies: Bosch, Continental, and Harman are bringing their expertise in sensors, communication modules, and infotainment systems to the party. They offer modular solutions that can be integrated into existing motorcycles, making connectivity more accessible.

- Startups: Nimble and innovative, startups like Ride Vision, SmartHalo, and Necto are disrupting the market with affordable aftermarket solutions. Their focus on specific functionalities like blind-spot detection, accident alerts, and voice-activated controls is attracting a wider customer base.

Market Share Analysis Factors:

- Product Portfolio: Offering a diverse range of features across safety, communication, entertainment, and navigation will be key to attracting different rider segments.

- Connectivity Ecosystem: Providing seamless integration with existing infrastructure and ensuring reliable data security will be crucial for user adoption.

- Pricing and Affordability: Balancing feature-richness with competitive pricing will be essential to penetrate budget-conscious segments.

- Partnerships and Collaborations: Strategic partnerships with technology providers, telecom operators, and motorcycle manufacturers can accelerate market reach and technology development.

Emerging Trends and Company Strategies:

- Advanced Rider Assistance Systems (ADAS): The integration of features like collision warning, lane departure warning, and adaptive cruise control is gaining traction, driven by safety concerns and regulatory push. Companies like Bosch and Continental are at the forefront of this trend.

- AI-powered Personalization: Customizing the riding experience based on individual preferences and real-time data is a promising avenue. Startups like Ride Vision are pioneering AI-powered coaching and route optimization solutions.

- V2X Communication: Enabling communication between motorcycles and other vehicles and infrastructure (V2V and V2I) holds immense potential for safety and traffic flow optimization. Companies like Autotalks and Necto are actively working on V2X solutions for motorcycles.

- Subscription-based Services: Offering software updates, on-demand features, and data packages as subscription services can generate recurring revenue and enhance customer engagement. Harley-Davidson's H-D Connect subscription service is an example of this approach.

Competitive Scenario and Outlook:

The connected motorcycle market is a dynamic space with a constantly evolving landscape. Competition is fierce, with established players leveraging their resources and startups offering innovative solutions. The ability to adapt to changing trends, forge strategic partnerships, and deliver value to riders will determine success. Ultimately, companies that can create a seamless, safe, and personalized riding experience will stand out in this exciting race.

This analysis provides a snapshot of the competitive landscape in the connected motorcycle market. By understanding the key players, their strategies, and emerging trends, companies can navigate this dynamic space and secure a winning position in the years to come.

Latest Company Updates:

Continental AG:

- Nov 2023: Partnered with Qualcomm to develop C-V2X communication technology for motorcycles, enabling vehicle-to-everything communication for enhanced safety and traffic flow. (Source: Continental press release)

Robert Bosch GmbH:

- Dec 2023: Bosch and Ducati collaborate on V2X communication project for motorcycles in Italy, focusing on accident prevention and traffic efficiency. (Source: Bosch press release)

Telit:

- Jan 2024: Announced a new motorcycle telematics solution with global cellular connectivity and GNSS tracking for fleet management and stolen vehicle recovery. (Source: Telit press release)

Yamaha Motors:

- Dec 2023: Unveiled the "Connected Motorcycle Vision" concept at CES 2024, showcasing advancements in rider assistance, communication, and infotainment. (Source: Yamaha website)

KTM:

- Jan 2024: Announced plans to introduce a new KTM Connect app with social features and ride tracking capabilities for its 2025 models. (Source: KTM website)