Increased Infrastructure Development

The ongoing expansion of infrastructure projects worldwide appears to be a primary driver for the Construction Equipment Attachment Market. Governments and private sectors are investing heavily in roads, bridges, and urban development, which necessitates the use of construction equipment and their attachments. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is likely to spur demand for various attachments, such as excavators and loaders, which enhance the efficiency and versatility of construction equipment. As infrastructure projects become more complex, the need for specialized attachments that can perform multiple functions is expected to rise, further propelling the market forward.

Technological Innovations in Attachments

Technological advancements in construction equipment attachments are significantly influencing the Construction Equipment Attachment Market. Innovations such as smart attachments equipped with sensors and IoT capabilities are enhancing operational efficiency and safety on job sites. These technologies allow for real-time monitoring and data collection, which can lead to better decision-making and resource management. The integration of automation and robotics into attachments is also on the rise, potentially transforming traditional construction practices. As these technologies become more accessible, they are likely to attract a broader range of customers, from small contractors to large construction firms, thereby expanding the market further.

Customization and Specialized Attachments

The demand for customization in construction equipment attachments is becoming a notable driver in the Construction Equipment Attachment Market. As construction projects vary widely in scope and requirements, contractors are increasingly seeking specialized attachments tailored to specific tasks. This trend is reflected in the growing market for custom attachments, which are designed to enhance the functionality of standard equipment. Data shows that the customization segment is expected to grow at a rate of 6% annually, as more companies recognize the benefits of using specialized tools for unique applications. This shift towards tailored solutions suggests that manufacturers will need to invest in research and development to meet the diverse needs of their clients.

Focus on Sustainability and Eco-Friendly Solutions

The increasing emphasis on sustainability within the construction sector is driving the Construction Equipment Attachment Market towards eco-friendly solutions. Companies are increasingly seeking attachments that minimize environmental impact, such as those that reduce fuel consumption and emissions. The market is witnessing a shift towards electric and hybrid attachments, which align with global sustainability goals. Data suggests that the demand for green construction practices is expected to grow, with a significant portion of construction firms committing to sustainable operations by 2030. This trend indicates that manufacturers of construction equipment attachments will need to innovate and adapt their products to meet these evolving environmental standards.

Rising Demand for Efficient Construction Solutions

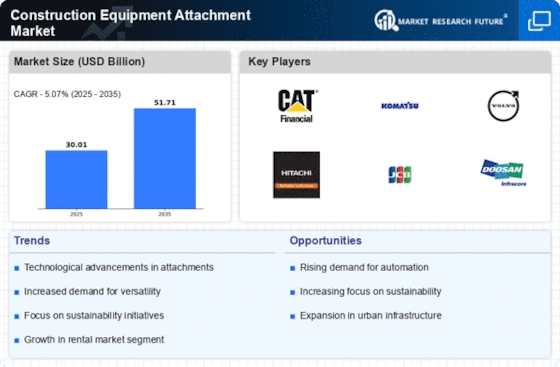

The Construction Equipment Attachment Market is experiencing a surge in demand for efficient construction solutions. As construction companies strive to optimize their operations and reduce costs, the adoption of advanced attachments that improve productivity is becoming increasingly prevalent. Data indicates that the market for construction equipment attachments is expected to reach USD 10 billion by 2026, driven by the need for enhanced performance and reduced operational downtime. Attachments such as hydraulic hammers and grapples are gaining traction as they allow for faster completion of tasks, thereby improving overall project timelines. This trend suggests that the market will continue to evolve, with a focus on innovative solutions that meet the growing demands of the construction sector.