Urbanization Trends

Rapid urbanization is a significant driver of the Global Heavy Construction Equipment Market Industry. As populations migrate to urban areas, the demand for residential, commercial, and infrastructure projects escalates. This trend is particularly evident in developing regions, where cities are expanding rapidly to accommodate growing populations. The need for heavy construction equipment, such as concrete mixers and loaders, is likely to increase as urban development projects proliferate. By 2035, the market is expected to reach 342.2 USD Billion, underscoring the impact of urbanization on equipment demand.

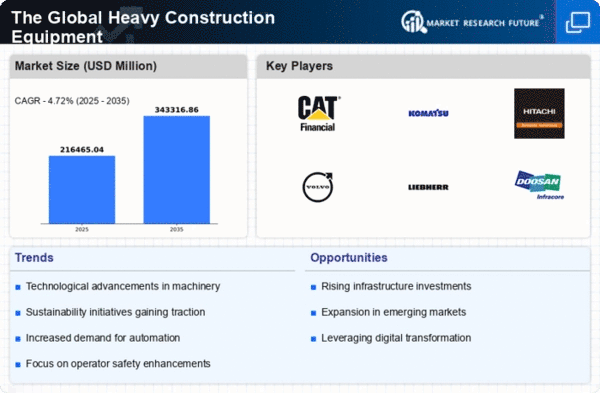

Market Growth Projections

The Global Heavy Construction Equipment Market Industry is projected to experience substantial growth over the next decade. With a market value of 206.7 USD Billion in 2024, the industry is expected to expand to 342.2 USD Billion by 2035. This growth trajectory, characterized by a CAGR of 4.69% from 2025 to 2035, reflects the increasing demand for heavy construction equipment driven by infrastructure development, urbanization, and technological advancements. Charts illustrating this growth can provide a visual representation of the market's potential, highlighting key trends and projections.

Technological Advancements

Technological advancements are playing a pivotal role in shaping the Global Heavy Construction Equipment Market Industry. Innovations such as automation, telematics, and electric machinery are enhancing operational efficiency and reducing environmental impact. For example, manufacturers are increasingly integrating IoT technology into their equipment, allowing for real-time monitoring and predictive maintenance. This shift not only improves productivity but also aligns with global sustainability goals. As a result, the market is poised for growth, with a projected CAGR of 4.69% from 2025 to 2035, reflecting the industry's adaptation to these technological changes.

Infrastructure Development Initiatives

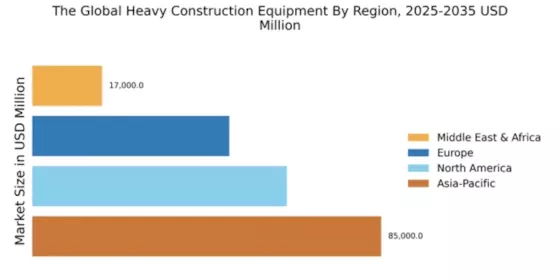

The Global Heavy Construction Equipment Market Industry is currently experiencing a surge due to extensive infrastructure development initiatives across various countries. Governments are investing heavily in transportation, energy, and urban development projects, which require advanced heavy construction equipment. For instance, the United States has allocated significant funding for infrastructure improvements, which is expected to drive demand for excavators, bulldozers, and cranes. This trend is reflected in the market's projected value of 206.7 USD Billion in 2024, indicating a robust growth trajectory fueled by these initiatives.

Increased Investment in Renewable Energy

The Global Heavy Construction Equipment Market Industry is witnessing a shift towards increased investment in renewable energy projects. Governments and private sectors are allocating substantial resources to develop wind, solar, and hydroelectric power facilities. This trend necessitates the use of specialized heavy construction equipment for the installation and maintenance of renewable energy infrastructure. As the world moves towards sustainable energy solutions, the demand for heavy machinery tailored for these projects is expected to rise. This shift could significantly impact market dynamics, contributing to the overall growth of the industry.

Regulatory Compliance and Safety Standards

The Global Heavy Construction Equipment Market Industry is influenced by stringent regulatory compliance and safety standards imposed by governments worldwide. These regulations necessitate the use of advanced equipment that meets safety and environmental criteria. For instance, the European Union has established regulations that require construction machinery to adhere to specific emissions standards. Consequently, manufacturers are compelled to innovate and produce cleaner, safer equipment. This focus on compliance not only drives demand for new machinery but also enhances the overall market value, contributing to the industry's growth.