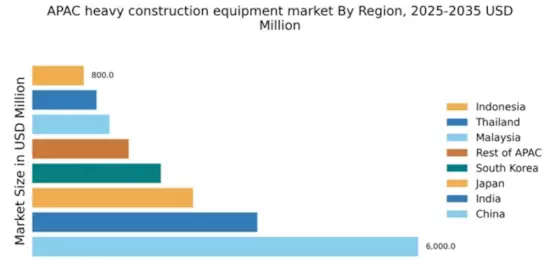

China : Unmatched Growth and Demand Trends

China holds a staggering 40% market share in the APAC heavy construction equipment sector, valued at $6000.0 million. Key growth drivers include rapid urbanization, government-backed infrastructure projects, and a booming real estate sector. The Chinese government has implemented favorable policies, such as tax incentives for construction firms, to stimulate demand. Additionally, the Belt and Road Initiative has further fueled industrial development, creating a robust demand for heavy machinery.

India : Infrastructure Boom Drives Equipment Demand

India accounts for 22% of the APAC market, valued at $3500.0 million. The country's growth is driven by significant investments in infrastructure, including highways, railways, and smart cities. Government initiatives like the National Infrastructure Pipeline aim to enhance construction activities, leading to increased demand for heavy equipment. The consumption pattern is shifting towards advanced machinery that offers efficiency and sustainability.

Japan : High-Quality Standards and Efficiency

Japan holds a 16.7% market share, valued at $2500.0 million. The market is characterized by a focus on technological innovation and high-quality standards. Key growth drivers include the aging infrastructure requiring upgrades and the push for automation in construction processes. Government policies support R&D in construction technologies, fostering a competitive environment for local manufacturers.

South Korea : Infrastructure Development and Urbanization

South Korea represents 13.3% of the APAC market, valued at $2000.0 million. The growth is propelled by urbanization and government investments in infrastructure projects, such as the Seoul subway expansion. The demand for advanced machinery is rising, driven by the need for efficiency and sustainability. Regulatory frameworks encourage the adoption of eco-friendly technologies in construction.

Malaysia : Strategic Investments in Infrastructure

Malaysia captures 8% of the APAC market, valued at $1200.0 million. The country is witnessing growth due to strategic investments in infrastructure, particularly in transportation and energy sectors. Government initiatives like the Malaysia Vision 2020 aim to enhance construction capabilities, leading to increased demand for heavy equipment. The market is characterized by a mix of local and international players competing for market share.

Thailand : Government Initiatives Boost Demand

Thailand holds a 6.7% market share, valued at $1000.0 million. The growth is driven by government initiatives aimed at enhancing infrastructure, including the Eastern Economic Corridor project. Demand for heavy construction equipment is increasing as the country focuses on improving transportation networks. The competitive landscape features both local and international players, with a focus on quality and reliability.

Indonesia : Infrastructure Needs Drive Market Growth

Indonesia accounts for 5.3% of the APAC market, valued at $800.0 million. The market is driven by significant infrastructure needs, particularly in transportation and energy sectors. Government initiatives, such as the National Medium-Term Development Plan, aim to boost construction activities. However, challenges like regulatory hurdles and financing issues persist, impacting market dynamics.

Rest of APAC : Varied Growth Across Sub-Regions

The Rest of APAC holds a 10% market share, valued at $1500.0 million. This sub-region encompasses diverse markets with varying growth drivers, including urbanization, infrastructure development, and economic reforms. Countries like Vietnam and the Philippines are emerging as key players, with increasing investments in construction. The competitive landscape features a mix of local and international companies, each adapting to unique market conditions.