Increased Focus on Energy Efficiency

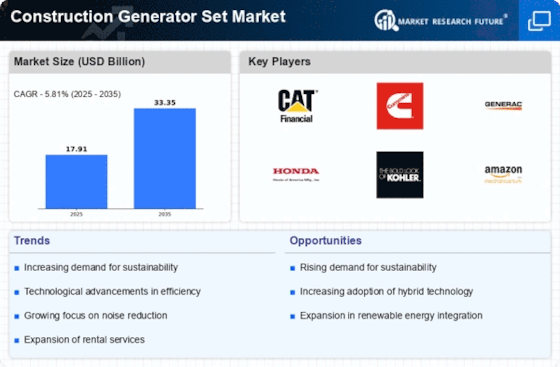

The Construction Generator Set Market is experiencing a heightened focus on energy efficiency among construction firms. As energy costs continue to rise, companies are seeking ways to optimize their power consumption and reduce operational expenses. In 2025, it is anticipated that the demand for energy-efficient generator sets will increase, as these solutions not only lower fuel consumption but also minimize environmental impact. The trend towards energy efficiency is likely to drive manufacturers to innovate and produce generator sets that meet these criteria. Consequently, the market may witness a shift towards more sustainable practices, aligning with broader industry goals of reducing carbon footprints and enhancing overall project sustainability.

Infrastructure Development Initiatives

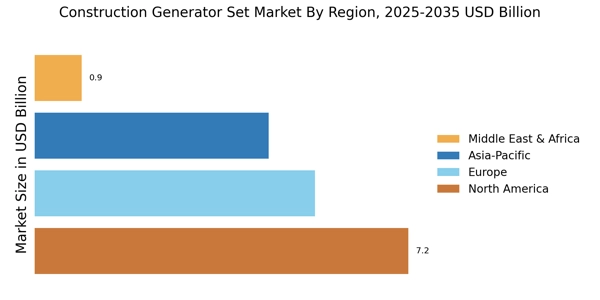

The Construction Generator Set Market is significantly impacted by ongoing infrastructure development initiatives. Governments and private sectors are investing heavily in infrastructure projects, including roads, bridges, and public facilities. In 2025, it is projected that these initiatives will create a robust demand for generator sets, as construction sites require reliable power sources to support various operations. The increasing focus on urbanization and the need for modern infrastructure are likely to further fuel this demand. As construction companies ramp up their activities to meet these needs, the generator set market is expected to experience substantial growth, driven by the requirements of large-scale projects.

Rising Demand for Temporary Power Solutions

The Construction Generator Set Market is experiencing a notable increase in demand for temporary power solutions. This trend is largely driven by the growing number of construction projects that require reliable power sources for tools and equipment. In 2025, the construction sector is projected to account for a substantial share of generator set usage, with estimates suggesting that the market could reach a valuation of over 10 billion USD. The need for uninterrupted power supply during construction activities, especially in remote locations, further propels this demand. As construction companies seek to enhance operational efficiency, the reliance on generator sets as a temporary power source is likely to continue its upward trajectory.

Technological Innovations in Generator Sets

The Construction Generator Set Market is witnessing a surge in technological innovations that enhance the performance and efficiency of generator sets. Advancements such as digital monitoring systems, remote control capabilities, and fuel-efficient engines are becoming increasingly prevalent. In 2025, it is expected that the integration of IoT technology will allow for real-time monitoring and predictive maintenance, reducing downtime and operational costs for construction companies. These innovations not only improve the reliability of power supply but also contribute to the overall sustainability of construction projects. As technology continues to evolve, the market for generator sets is likely to expand, driven by the demand for smarter and more efficient solutions.

Regulatory Compliance and Emission Standards

The Construction Generator Set Market is increasingly influenced by stringent regulatory compliance and emission standards. Governments are implementing more rigorous environmental regulations, compelling construction companies to adopt cleaner and more efficient generator sets. In 2025, it is anticipated that the market will see a shift towards low-emission technologies, with a significant portion of generator sets being equipped with advanced emission control systems. This transition not only aligns with global sustainability goals but also enhances the competitiveness of construction firms. As a result, manufacturers are likely to innovate and develop generator sets that meet these evolving standards, thereby driving growth in the market.