Rising Energy Demand

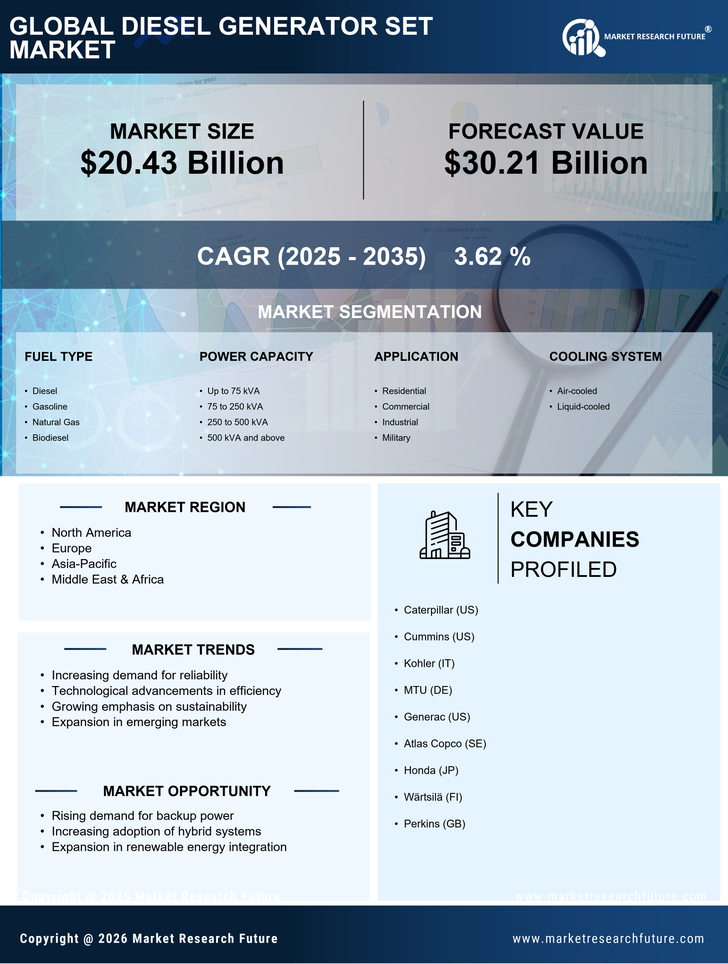

The Diesel Generator Set Market is experiencing a notable surge in energy demand, driven by rapid urbanization and industrialization. As populations grow and economies expand, the need for reliable power sources becomes increasingly critical. In many regions, particularly in developing areas, the existing power infrastructure struggles to meet the rising demand. This gap creates a substantial opportunity for diesel generator sets, which are often deployed as backup or primary power sources. According to recent data, the diesel generator set market is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is indicative of the increasing reliance on diesel generators to ensure uninterrupted power supply across various sectors, including construction, healthcare, and manufacturing.

Technological Innovations

Technological innovations are transforming the Diesel Generator Set Market, enhancing the efficiency and performance of diesel generators. Advances in engine technology, fuel efficiency, and emissions control are making modern diesel generators more appealing to consumers. For instance, the introduction of smart generator systems allows for remote monitoring and management, which can optimize fuel consumption and reduce operational costs. Furthermore, the integration of hybrid technologies is becoming more prevalent, enabling diesel generators to work in conjunction with renewable energy sources. This shift towards more advanced and environmentally friendly solutions is expected to drive market growth, as consumers seek to balance reliability with sustainability.

Infrastructure Development

Infrastructure development plays a pivotal role in the expansion of the Diesel Generator Set Market. Governments and private entities are investing heavily in infrastructure projects, including roads, bridges, and airports, which necessitate a reliable power supply. Diesel generators are often utilized on construction sites to provide the necessary energy for machinery and equipment. The construction sector alone is expected to contribute significantly to the diesel generator set market, with estimates suggesting that it could account for over 30% of the total market share by 2026. This trend underscores the importance of diesel generators in supporting large-scale infrastructure projects, particularly in regions where grid power is unreliable or unavailable.

Increased Frequency of Power Outages

The Diesel Generator Set Market is also influenced by the increasing frequency of power outages in various regions. Factors such as extreme weather events, aging infrastructure, and rising energy consumption contribute to this phenomenon. As a result, businesses and households are increasingly turning to diesel generators as a reliable backup power solution. Data indicates that the frequency of outages has risen by approximately 20% in certain areas over the past decade, prompting a shift in consumer behavior towards investing in diesel generator sets. This trend is likely to continue, as the need for uninterrupted power supply becomes paramount for both residential and commercial users.

Regulatory Compliance and Environmental Standards

The Diesel Generator Set Market is increasingly shaped by regulatory compliance and environmental standards. Governments worldwide are implementing stricter emissions regulations, prompting manufacturers to innovate and produce cleaner diesel generators. This shift is not only a response to environmental concerns but also a market demand for more sustainable energy solutions. As a result, the market is witnessing a rise in the development of low-emission diesel generators that meet these stringent standards. Data suggests that the market for such generators is expected to grow significantly, as businesses and industries seek to comply with regulations while maintaining operational efficiency. This trend highlights the dual challenge of meeting regulatory requirements and ensuring reliable power supply.