Shift Towards Hybrid Energy Solutions

The Gas-Fired Construction Generator Set Market is witnessing a shift towards hybrid energy solutions that combine gas-fired generators with renewable energy sources. This trend is driven by the need for more sustainable energy practices in construction. Hybrid systems can optimize energy use, reduce fuel costs, and lower emissions, making them an attractive option for construction companies. The integration of renewable energy with gas-fired generators not only enhances energy reliability but also aligns with global sustainability goals. As the market evolves, the adoption of hybrid solutions is expected to gain traction, further propelling the growth of the gas-fired generator sector.

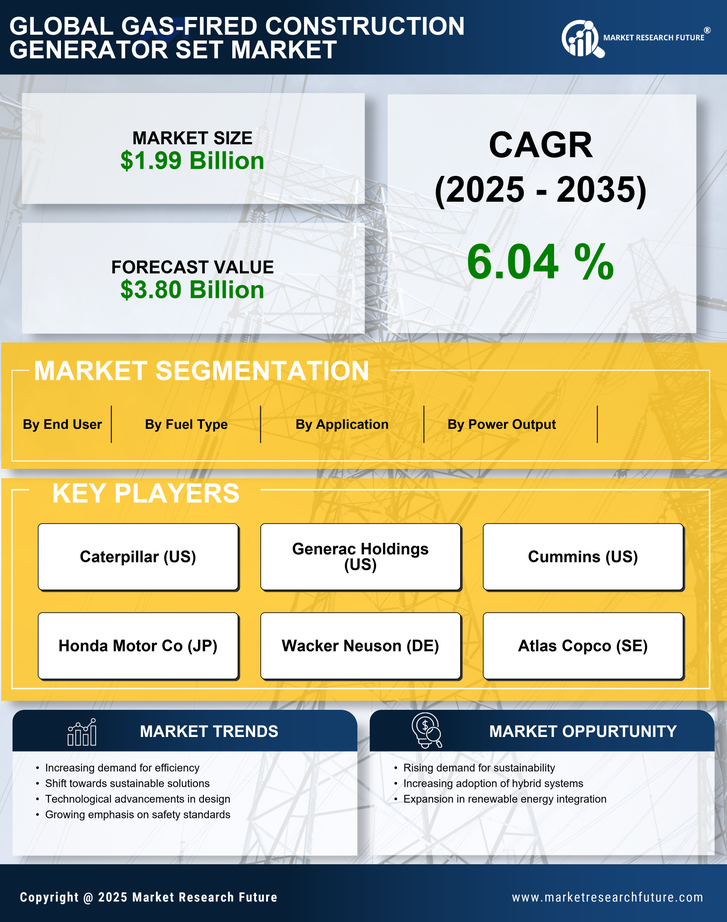

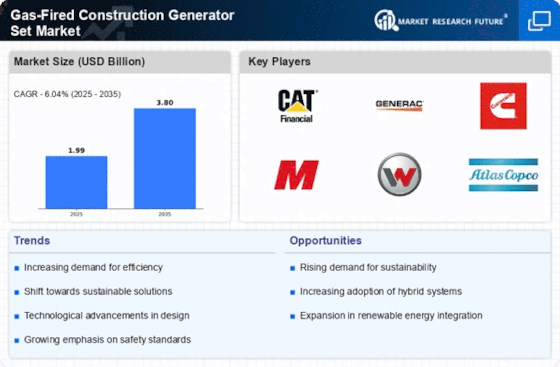

Increasing Demand for Reliable Power Sources

The Gas-Fired Construction Generator Set Market is experiencing a notable surge in demand for reliable power sources, particularly in construction projects that require uninterrupted energy supply. As construction activities expand, the need for dependable generators becomes paramount. This trend is underscored by the fact that construction sites often face power outages, which can lead to significant delays and increased costs. The market for gas-fired generators is projected to grow, driven by their ability to provide consistent power while being more environmentally friendly compared to diesel alternatives. The increasing adoption of gas-fired generators is indicative of a broader shift towards sustainable energy solutions in the construction sector.

Regulatory Support for Cleaner Energy Solutions

The Gas-Fired Construction Generator Set Market benefits from a favorable regulatory environment that increasingly supports cleaner energy solutions. Governments are implementing policies aimed at reducing carbon emissions, which encourages the adoption of gas-fired generators over traditional diesel units. This regulatory push is reflected in various initiatives that promote the use of natural gas as a cleaner alternative, thereby enhancing the market's growth potential. The market is likely to see an uptick in investments as construction companies seek to comply with these regulations while also improving their sustainability profiles. The alignment of regulatory frameworks with market needs suggests a promising future for gas-fired generator sets.

Technological Advancements in Generator Efficiency

Technological advancements are playing a crucial role in shaping the Gas-Fired Construction Generator Set Market. Innovations in generator design and efficiency are leading to enhanced performance and reduced operational costs. Modern gas-fired generators are equipped with advanced control systems that optimize fuel consumption and minimize emissions. This technological evolution not only improves the reliability of power supply on construction sites but also aligns with the industry's growing emphasis on sustainability. As efficiency standards continue to rise, the market is expected to expand, driven by the demand for high-performance generators that meet stringent environmental regulations.

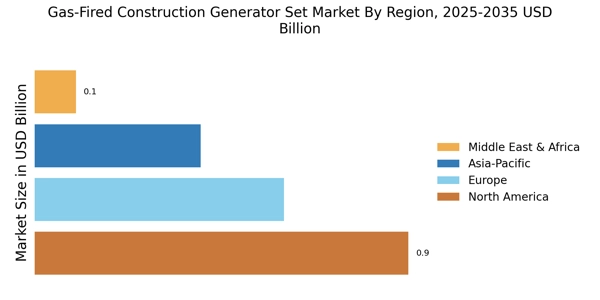

Rising Construction Activities in Emerging Economies

The Gas-Fired Construction Generator Set Market is poised for growth due to the rising construction activities in emerging economies. As urbanization accelerates, there is a corresponding increase in infrastructure development, which necessitates reliable power solutions. Gas-fired generators are becoming the preferred choice in these regions due to their efficiency and lower environmental impact. The construction boom in countries with developing economies is likely to drive demand for gas-fired generator sets, as these units provide a practical solution to power challenges faced on-site. This trend indicates a robust market outlook as investments in construction continue to rise.