Rising Consumer Awareness

Consumer awareness regarding product safety is at an all-time high, significantly impacting the Consumer Product Safety Testing Market. With access to information through digital platforms, consumers are increasingly demanding transparency from manufacturers about the safety of their products. This shift in consumer behavior is prompting companies to prioritize safety testing and certification to build trust and brand loyalty. According to recent surveys, over 70% of consumers consider product safety as a critical factor in their purchasing decisions. Consequently, businesses are investing more in safety testing to meet these expectations, thereby driving growth in the Consumer Product Safety Testing Market.

Global Supply Chain Complexity

The complexity of The Consumer Product Safety Testing Industry. As companies source materials and components from various regions, ensuring product safety becomes increasingly challenging. This complexity necessitates rigorous testing to identify potential risks associated with different materials and manufacturing processes. Moreover, incidents of product recalls due to safety issues have underscored the importance of thorough testing. The market is responding to this challenge by offering comprehensive testing services that address the intricacies of global supply chains. This trend is likely to contribute to a steady increase in demand for safety testing services within the Consumer Product Safety Testing Market.

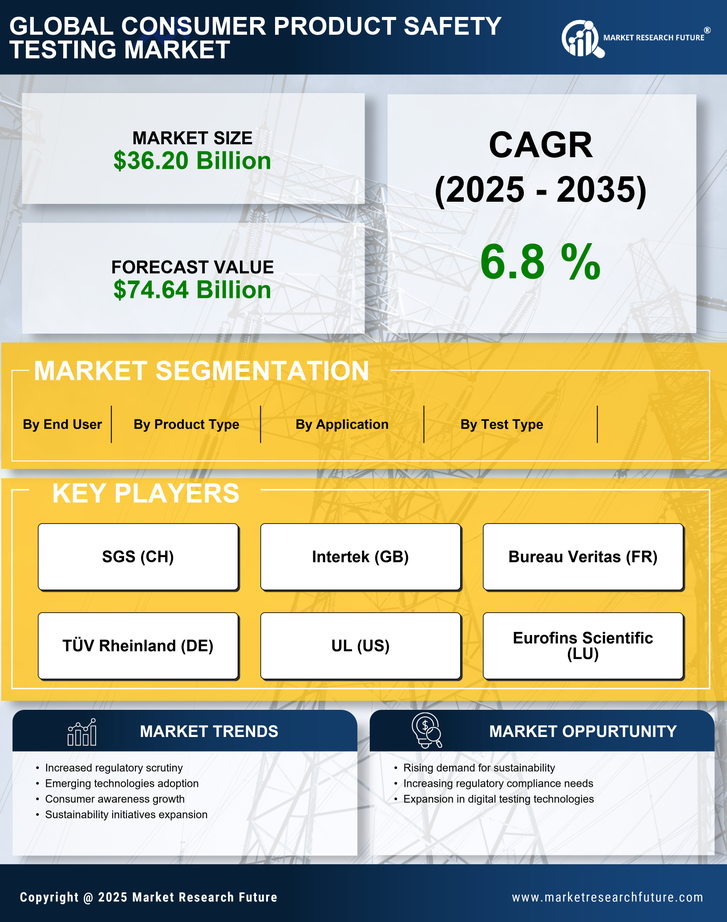

Increased Regulatory Compliance

The Consumer Product Safety Testing Market is experiencing heightened regulatory compliance requirements across various sectors. Governments and regulatory bodies are implementing stricter safety standards to protect consumers from hazardous products. This trend is evident in the rise of regulations such as the Consumer Product Safety Improvement Act, which mandates rigorous testing protocols. As a result, companies are compelled to invest in comprehensive safety testing to ensure compliance, thereby driving demand within the Consumer Product Safety Testing Market. The market is projected to grow at a compound annual growth rate of approximately 7% over the next five years, reflecting the increasing emphasis on safety and compliance.

Sustainability and Eco-Friendly Products

The growing emphasis on sustainability is reshaping the Consumer Product Safety Testing Market. As consumers become more environmentally conscious, there is a rising demand for eco-friendly products that adhere to safety standards. Manufacturers are increasingly required to ensure that their products are not only safe but also sustainable. This trend is driving the need for specialized testing services that evaluate the safety of environmentally friendly materials and processes. The market for sustainable products is projected to grow significantly, with estimates suggesting a potential increase of 10% annually. Consequently, the Consumer Product Safety Testing Market is adapting to these changes by expanding its testing capabilities to include sustainability assessments.

Technological Innovations in Testing Methods

Technological advancements are revolutionizing the Consumer Product Safety Testing Market. Innovations such as artificial intelligence, machine learning, and automation are enhancing testing efficiency and accuracy. These technologies enable faster identification of potential hazards and streamline the testing process, which is crucial for manufacturers aiming to meet safety standards. For instance, the integration of AI in testing protocols can reduce testing time by up to 30%, allowing companies to bring products to market more swiftly. As manufacturers seek to leverage these advancements, the demand for sophisticated testing solutions is expected to rise, further propelling the growth of the Consumer Product Safety Testing Market.