North America : Market Leader in Innovation

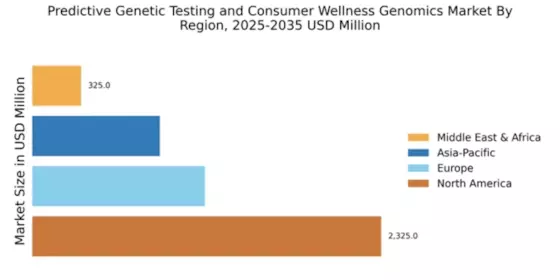

North America continues to lead the Predictive Genetic Testing and Consumer Wellness Genomics Market, holding a significant market share of $2325.01M in 2025. The growth is driven by increasing consumer awareness, advancements in technology, and supportive regulatory frameworks. The demand for personalized health insights and preventive healthcare solutions is on the rise, further fueled by the integration of genetic testing in routine health assessments. The competitive landscape is robust, with key players like 23andMe, Ancestry, and Invitae dominating the market. The U.S. is the primary contributor, supported by a strong healthcare infrastructure and a high adoption rate of genetic testing services. The presence of innovative companies and ongoing research initiatives positions North America as a hub for advancements in genomics and personalized medicine.

Europe : Emerging Market with Growth Potential

Europe's Predictive Genetic Testing and Consumer Wellness Genomics Market is valued at $1150.0M in 2025, reflecting a growing interest in genetic testing among consumers. The market is driven by increasing health consciousness, regulatory support for genetic testing, and advancements in technology. Countries are implementing policies to promote genetic research and testing, enhancing accessibility and affordability for consumers. Leading countries in this region include Germany, the UK, and France, where significant investments in healthcare technology are being made. The competitive landscape features companies like MyHeritage and Color Genomics, which are expanding their services. The European market is characterized by a mix of established players and emerging startups, fostering innovation and collaboration in the genomics space.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region is witnessing a surge in the Predictive Genetic Testing and Consumer Wellness Genomics Market, valued at $850.0M in 2025. This growth is attributed to rising disposable incomes, increasing health awareness, and a growing population interested in preventive healthcare. Regulatory bodies are also beginning to recognize the importance of genetic testing, leading to more supportive policies and frameworks. Countries like Australia, Japan, and China are at the forefront of this market, with a growing number of companies entering the space. Key players such as Genetic Technologies and Fulgent Genetics are expanding their reach. The competitive landscape is evolving, with both local and international firms vying for market share, indicating a promising future for genetic testing in the region.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa region is gradually developing its Predictive Genetic Testing and Consumer Wellness Genomics Market, currently valued at $325.02M in 2025. The growth is driven by increasing awareness of genetic health issues and a rising demand for personalized healthcare solutions. However, challenges such as regulatory hurdles and limited access to advanced healthcare technologies persist, impacting market growth. Countries like South Africa and the UAE are leading the way in adopting genetic testing services. The competitive landscape is characterized by a mix of local and international players, with companies beginning to invest in the region. As awareness grows, the market is expected to expand, driven by both consumer demand and governmental support for healthcare initiatives.