Market Share

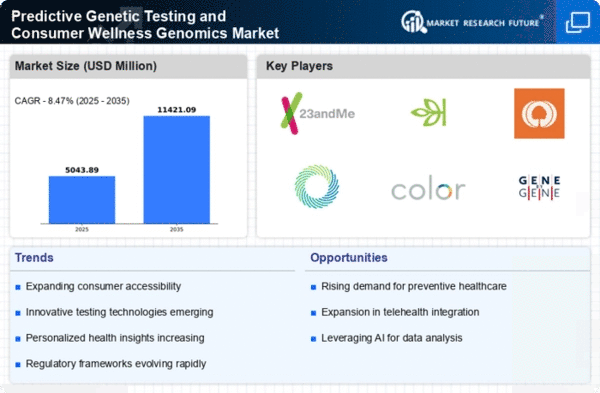

Predictive Genetic Testing and Consumer Wellness Genomics Market Share Analysis

The predictive genetic testing and consumer wellness genomics industry have undergone tremendous expansion, driven by rising consumer interest in customized healthcare. Companies in this competitive industry are carefully positioning themselves to gain a considerable portion by delivering revolutionary genetic testing services that give insights into health concerns, heritage, and general wellbeing.

To appeal to a wide client base, corporations are broadening their genetic testing offerings. Beyond standard health risk evaluations, options also include ancestry testing, dietary analysis, and insights into fitness predispositions. This diversity draws a larger audience, placing organizations advantageously in the competitive environment. Market leaders are investing in the integration of modern genomic technologies. Adopting cutting-edge sequencing methods and bioinformatics tools boosts the quality and depth of genetic information offered to customers, providing enterprises a competitive advantage in offering complete and accurate genetic insights. Enhancing user experience is a primary emphasis in this business. Companies are creating user-friendly genetic testing kits and internet platforms, simplifying the sample collection procedure and delivering accessible and easy-to-understand findings. This method stimulates better customer participation and develops brand loyalty. Collaborations with healthcare providers are a deliberate effort to incorporate genetic testing into wider healthcare activities. Partnerships with clinics and hospitals enable firms to reach a larger audience, and the incorporation of genetic data into medical records helps more holistic healthcare management. Given the sensitive nature of genetic information, companies are prioritizing privacy and data security measures. Implementing powerful encryption, safe data storage, and explicit privacy rules generate confidence among customers, ensuring them that their genetic data is treated with the highest secrecy. Companies are launching initiatives to educate consumers about their genetic information. Educational material, webinars, and interactive platforms help customers make educated genetic testing decisions, increasing their value. Compliance with multiple regulatory systems helps companies develop abroad. Following international standards and securing regulatory clearances makes genetic testing services available to customers worldwide, increasing market share. Research and development are needed to advance genomics. Companies are investing in continuing investigations to uncover new genetic markers and connections to extend their testing services and provide customers the newest genetic information. Companies are using low prices and subscription schemes to entice more customers. Offering several levels of testing services with varied price points and subscription choices lets customers pick packages that fit their budget and tastes, expanding market penetration.

Leave a Comment