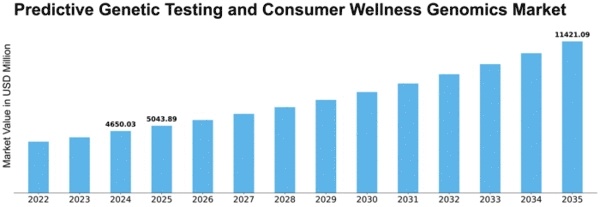

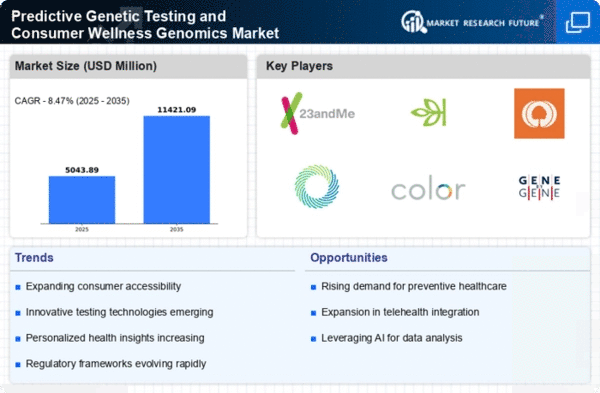

Predictive Genetic Testing And Consumer Wellness Genomics Size

Predictive Genetic Testing and Consumer Wellness Genomics Market Growth Projections and Opportunities

Consumer desire in customized health information drives predictive genetic testing and consumer wellness genomics. People research their genetic predispositions to reduce illness risk, optimize lifestyle choices, and manage their health.

This market grows due to genetic technology advances. Advanced bioinformatics and high-throughput sequencing offer more accurate genetic testing. Predictive genetic testing and wellness genomics services become more affordable as genomic sequencing costs fall.

Increased consumer understanding of genetics in health affects the market. Media coverage, education, and healthcare advocacy help people realize how genetic testing might forecast illness vulnerability and implement preventative or early intervention actions.

Consumers may actively engage in healthcare decisions using predictive genetic testing. Understanding genetic predispositions helps people make lifestyle, preventive, and healthcare decisions. This customized decision-making trend pushes predictive genetic testing and wellness genomics. The popularity of direct-to-consumer genetic testing services drives market growth. Consumers can get genetic insights without healthcare intermediaries from at-home testing kits. It gives customers a more direct and customized contact with their genetic data.

Genomic data complexity requires specialized interpretation services. Companies offering comprehensive and easy-to-use genomic data interpretation tools see demand. The market responds with sophisticated algorithms and platforms that provide actionable insights, improving predictive genetic testing and wellness genomics. The digital health trend drives predictive genetic testing and wellness genomics integration with digital health platforms. Integration with mobile apps, wearables, and other digital health tools improves the consumer experience and lets people use genetic insights in their daily routines. The global shift toward preventive healthcare makes predictive genetic testing more important. People are increasingly interested in genetic markers linked to lifestyle-preventable diseases. Genetic testing services support proactive health management, aligning with this prevention focus. Genetic testing ethics and privacy affect the market. Data security and privacy awareness affects consumer testing willingness. Companies that address these concerns with transparency and strong privacy measures gain an edge in predictive genetic testing and consumer wellness genomics. Research and collaborations between genetic testing companies, healthcare providers, and research institutions drive market growth. Scientific advances, new genetic markers, and collaborative efforts to expand predictive genetic testing applications improve consumer value.

Leave a Comment