Growing Awareness of Eye Health

Increased awareness of eye health and the importance of regular eye examinations significantly influences the Global Contact and Intraocular Lenses Market Industry. Educational campaigns by health organizations and optometrists emphasize the necessity of vision correction, leading to higher demand for corrective lenses. This trend is particularly evident in developing regions, where access to eye care services is improving. As individuals become more proactive about their eye health, the market is poised for growth. The anticipated compound annual growth rate of 7.22% from 2025 to 2035 reflects this rising consciousness and its impact on lens adoption rates.

Expansion of E-commerce Platforms

The rise of e-commerce platforms has transformed the Global Contact and Intraocular Lenses Market Industry by providing consumers with convenient access to a wide range of products. Online retailers offer competitive pricing and the convenience of home delivery, appealing to tech-savvy consumers. This shift in purchasing behavior is particularly pronounced among younger demographics who prefer online shopping. As e-commerce continues to expand, it is likely to drive sales growth in the contact and intraocular lens segments. The ease of access to various brands and types of lenses online may further enhance market penetration and consumer engagement.

Rising Prevalence of Vision Disorders

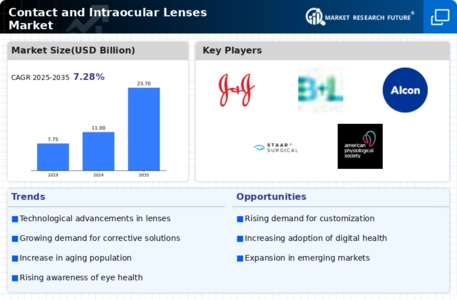

The Global Contact and Intraocular Lenses Market Industry experiences growth driven by the increasing prevalence of vision disorders such as myopia, hyperopia, and astigmatism. As populations age, the demand for corrective lenses rises, with millions affected globally. For instance, the World Health Organization indicates that uncorrected refractive errors affect approximately 2.7 billion people worldwide. This growing need for vision correction fuels the market, which is projected to reach 11 USD Billion in 2024. The demand for both contact lenses and intraocular lenses is likely to continue expanding as awareness of eye health increases.

Technological Advancements in Lens Design

Technological innovations play a pivotal role in shaping the Global Contact and Intraocular Lenses Market Industry. Advances in materials and manufacturing processes have led to the development of more comfortable, durable, and effective lenses. For example, the introduction of silicone hydrogel materials has enhanced oxygen permeability, improving wearability for contact lens users. Furthermore, the emergence of multifocal and toric lenses caters to diverse vision needs, thereby broadening the consumer base. These advancements are expected to contribute to the market's growth trajectory, potentially reaching 23.7 USD Billion by 2035, as consumers increasingly seek high-quality vision correction solutions.

Increasing Investment in Eye Care Infrastructure

Investment in eye care infrastructure is a crucial driver for the Global Contact and Intraocular Lenses Market Industry. Governments and private entities are increasingly funding eye care facilities and services, particularly in underserved regions. This investment not only improves access to eye care but also promotes the adoption of advanced lens technologies. Enhanced infrastructure facilitates better diagnosis and treatment options, leading to a higher demand for both contact and intraocular lenses. As eye care becomes more accessible, the market is expected to flourish, aligning with the projected growth trends in the coming years.