Rising Demand in Electronics

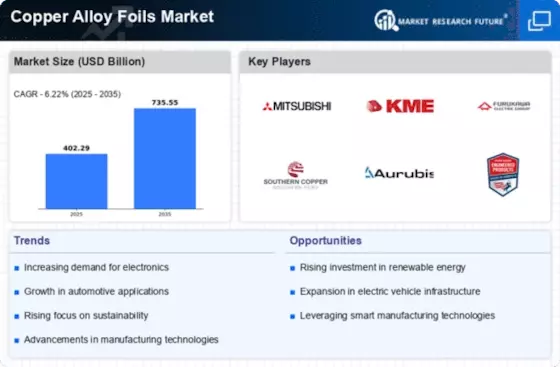

The Copper Alloy Foils Market is experiencing a notable surge in demand driven by the electronics sector. As electronic devices become increasingly compact and efficient, the need for high-performance materials like copper alloy foils is paramount. These foils are integral in the manufacturing of printed circuit boards (PCBs), connectors, and other electronic components. Recent data indicates that the electronics industry is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next few years, further propelling the demand for copper alloy foils. This trend suggests that manufacturers in the Copper Alloy Foils Market must adapt to the evolving requirements of the electronics sector to maintain competitiveness.

Automotive Industry Transformation

The Copper Alloy Foils Market is witnessing a transformation driven by the automotive sector's shift towards electric vehicles (EVs). As the automotive industry increasingly embraces electrification, the demand for lightweight and efficient materials, such as copper alloy foils, is on the rise. These materials are crucial for various applications, including battery connections and electric motor components. Data suggests that the electric vehicle market is expected to grow at a CAGR of over 20% in the next few years, indicating a robust demand for copper alloy foils. This trend highlights the necessity for the Copper Alloy Foils Market to innovate and provide solutions that meet the specific needs of the evolving automotive landscape.

Infrastructure Development Initiatives

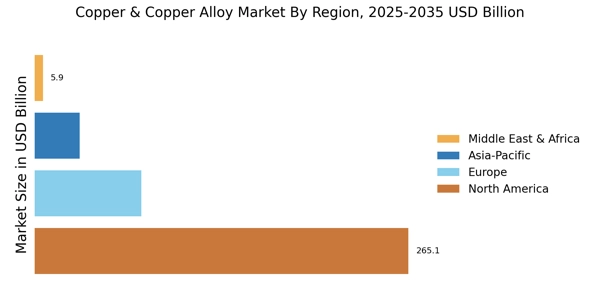

The Copper Alloy Foils Market is benefiting from ongoing infrastructure development initiatives across various regions. Governments are investing heavily in infrastructure projects, including transportation, telecommunications, and energy systems, which require high-quality materials. Copper alloy foils are utilized in a range of applications, from wiring in construction to components in communication systems. Recent reports indicate that infrastructure spending is projected to increase significantly, with many countries prioritizing modernization efforts. This trend is likely to create a favorable environment for the Copper Alloy Foils Market, as demand for reliable and efficient materials continues to grow.

Advancements in Manufacturing Processes

The Copper Alloy Foils Market is experiencing a shift due to advancements in manufacturing processes. Innovations such as improved rolling techniques and enhanced alloy compositions are enabling manufacturers to produce thinner and more efficient foils. These advancements not only enhance the performance of copper alloy foils but also reduce production costs, making them more accessible to various industries. Recent data suggests that the efficiency of manufacturing processes in the Copper Alloy Foils Market has improved by approximately 15% over the past few years. This progress indicates a potential for increased market penetration and competitiveness, as manufacturers strive to meet the diverse needs of their customers.

Growth in Renewable Energy Applications

The Copper Alloy Foils Market is poised for growth due to the increasing adoption of renewable energy technologies. Copper alloys are essential in the production of components for solar panels and wind turbines, where their excellent conductivity and durability are highly valued. As countries strive to meet renewable energy targets, the demand for copper alloy foils is expected to rise. Recent statistics indicate that the renewable energy sector is anticipated to expand significantly, with investments projected to reach trillions of dollars in the coming decade. This growth presents a substantial opportunity for the Copper Alloy Foils Market to capitalize on the burgeoning demand for sustainable energy solutions.