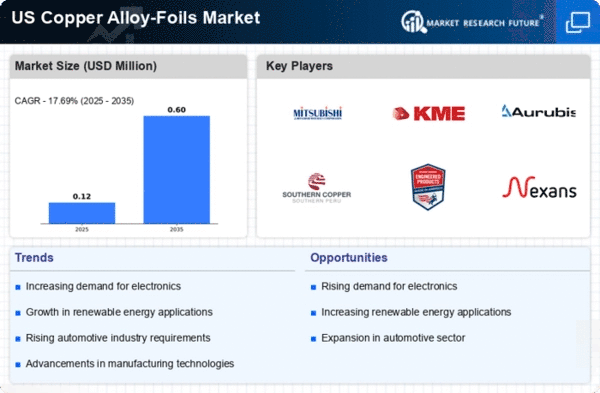

Automotive Sector Expansion

The automotive industry significantly influences the copper alloy-foils market, particularly with the rise of electric vehicles (EVs). As the automotive sector shifts towards electrification, the demand for lightweight and conductive materials increases. Copper alloy foils are essential in various automotive applications, including battery connections and electric motor components. In 2025, the automotive sector is expected to represent around 25% of the copper alloy-foils market. This shift not only enhances the performance of EVs but also aligns with the industry's sustainability goals. The integration of advanced copper alloy foils in automotive manufacturing processes is likely to drive innovation and efficiency, thereby propelling the overall market forward. The ongoing transition towards greener technologies further underscores the importance of copper alloy foils in the automotive landscape.

Rising Demand in Electronics

The copper alloy-foils market experiences a notable surge in demand driven by the expanding electronics sector. As technology advances, the need for high-performance materials in devices such as smartphones, laptops, and tablets increases. In 2025, the electronics industry is projected to account for approximately 30% of the total demand for copper alloy foils. This growth is attributed to the rising trend of miniaturization and the need for efficient thermal and electrical conductivity in electronic components. Consequently, manufacturers are focusing on producing high-quality copper alloy foils to meet the stringent requirements of the electronics market. The increasing integration of copper alloy foils in printed circuit boards (PCBs) further enhances their significance in the copper alloy-foils market, indicating a robust growth trajectory in the coming years.

Increased Investment in Infrastructure

The copper alloy-foils market will benefit from increased investment in infrastructure projects across the U.S. As the government and private sectors allocate funds for modernization and expansion, the demand for conductive materials rises. Copper alloy foils are integral to various infrastructure applications, including telecommunications and power distribution systems. In 2025, infrastructure investments are projected to contribute around 10% to the copper alloy-foils market. This trend reflects a broader commitment to enhancing connectivity and energy efficiency. The integration of copper alloy foils in smart grid technologies and communication networks further underscores their importance in modern infrastructure. As these projects progress, the copper alloy-foils market is likely to experience sustained growth, driven by the need for reliable and efficient materials.

Innovations in Manufacturing Processes

Innovations in manufacturing processes are transforming the copper alloy-foils market, enabling the production of higher quality and more efficient materials. Advanced techniques such as roll-to-roll processing and precision etching are enhancing the capabilities of manufacturers. These innovations allow for the creation of thinner and more conductive foils, which are essential for modern applications in electronics and automotive sectors. In 2025, it is estimated that advancements in manufacturing could lead to a 20% increase in production efficiency within the copper alloy-foils market. This improvement not only reduces costs but also meets the growing demand for high-performance materials. As manufacturers adopt these cutting-edge technologies, the overall competitiveness of the copper alloy-foils market is likely to strengthen, fostering further growth and development.

Growth in Renewable Energy Applications

The copper alloy-foils market is expected to grow due to the increasing adoption of renewable energy technologies. As the U.S. aims to transition towards sustainable energy sources, the demand for efficient conductive materials in solar panels and wind turbines rises. Copper alloy foils play a crucial role in enhancing the efficiency of these renewable energy systems. In 2025, the renewable energy sector is anticipated to contribute approximately 15% to the copper alloy-foils market. This trend reflects a broader commitment to reducing carbon emissions and promoting sustainable practices. The integration of copper alloy foils in energy storage systems, such as batteries, further amplifies their relevance in the renewable energy landscape. As investments in clean energy technologies continue to grow, the copper alloy-foils market is likely to benefit from this shift.